In the wake of the crisis, finance has been no stranger to disruptive forces. From an increased regulatory environment to the rapid pace of technological change, the financial world has weathered a perfect storm of disruption in short order.

In the wake of the crisis, finance has been no stranger to disruptive forces. From an increased regulatory environment to the rapid pace of technological change, the financial world has weathered a perfect storm of disruption in short order.

Nimble businesses dodging their own “Kodak moments” watch disruptors as signals for how to evolve. And disruptors can inform investors as they look toward the future and build their portfolios.

Last week I attended an investing summit keynoted by financial television icon Maria Bartiromo. Jetsetter that she is, Maria had just arrived back from some of the most prominent business and finance conferences around the world where she picked the brains of business moguls. Maria said that as an investor and journalist, she is always on the lookout for the disruptors having the greatest impact her life and the world around her. Here are some of the forces she sees affecting investors today:

- Everyday Americans’ Economic Recovery?: Unemployment may be improving, but as we dig deeper into the economic data, retail sales and consumer sentiment remains shaky. Wages still haven’t budged much and, despite oil windfalls, Americans are clutching their purse-strings. Instead of low gas prices spurring spending, Americans’ savings account balances have gone up.

- The Hunt for Yield Remains: Investors continue to flock toward equities and dividend-yielding stocks in this low interest rate environment, which may not budge until the fall.

- Banks Concerned About Liquidity: In the post-crisis regulatory environment, banks are forced to hold more capital, which could affect their ability to lend, according to Jamie Dimon, CEO of JPMorgan.

- When Health & Tech Collide: Maria says we are just now scratching the surface of what we can do with the immense amount of data medical researchers are gathering. We’re on the brink of beating a number of diseases as we leverage technology to look for cures.

- Happy 110th, Ma: One source told Maria that in the next ten years, we’ll be living into our second centuries. As Americans’ life expectancies rise with better medical research and treatments, we will have to completely adjust how we think about and prepare for retirement as a nation.

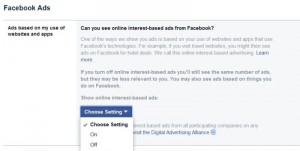

- Companies Splurge on Cyber Security: With the expansion of the Internet of Things, Cisco’s CEO John Chambers has warned that we’ll see an increase in the number of hack attacks in 2015, such as Anthem’s recent breach. It’s no wonder that one of companies’ biggest expenses this year is protecting customer data. As hackers become more sophisticated, protecting customer privacy will be more important than ever.

- (Skilled) Help Wanted at Walmart: The skills gap is not only an issue in Silicon Valley. In fact, when Maria asked CEO of Walmart Doug McMillon why they decided to give their workers a raise, he said that they simply could not find and attract the quality of workers needed to work at Walmart.

- Don’t Bet on Auto: Uber CEO Travis Kalanick recently told Maria that city dwellers will not want to own cars in five to 10 years. While it remains to be seen whether Uber will continue to boom, Kalanick envisions a world where car ownership will become a rarity for those living in metropolitan areas.

- The U.S. is Still the Best Game in Town: While our economy is by no means perfect, Maria told investors that the U.S. is still looking the brightest with China’s slow-down, political uncertainty in the Middle East, and investors continuing to wait on emerging markets to surge to no avail.

As investors and companies navigate the changing economic climate, these disruptors are certainly ones to watch. What disruptive forces do you see changing the game in 2015?

Photo credit: The Paley Center For Media, Flickr.

(226)