Nielsen Predicts Ready-To-Drink Cocktail Shakeout In 2023

Ready-to-drink (RTD) cocktails will face major SKU shifts by retailers in 2023, while non-alcohol spirits continue to proliferate.

Those predictions from NielsenIQ and its CGA on-premise insights unit come as people who represent nearly half of all beverage alcohol purchasers on a dollar basis have expressed financial optimism.

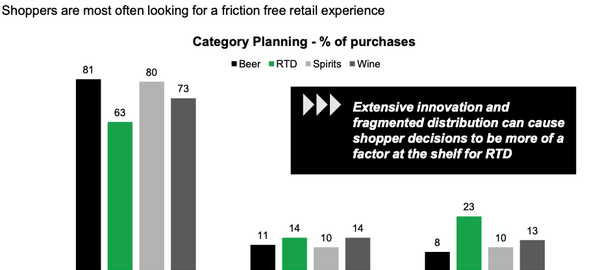

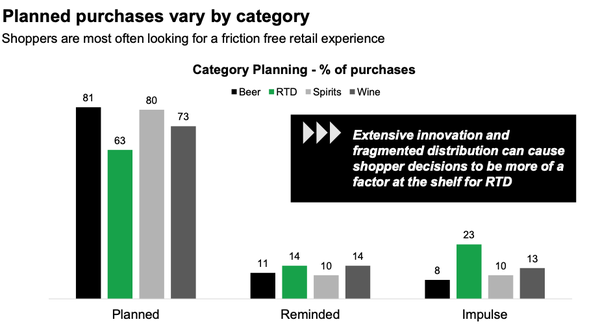

Among other findings, the data show that RTD purchases at the retail level are the most impulse-oriented—at 23%—compared to 13% for wine, 10% for spirits and 8% for beer.

But as more RTD variations flood the market, “heavy duty” SKU cuts are inevitable, according to NielsenIQ vice president of thought leadership Jon Berg.

“When we talk to retailers, they say ‘look, I’ve got to make some decisions here. This doesn’t all fit on the shelf, this doesn’t all go in my cooler doors,’” Berg said in a recent presentation.

Meanwhile, wine-based RTDs will up their game next year.

“I’m predicting that you’re going to see some more extensive innovation in terms of what wine RTDs are bringing to the table, and some of the functional attributes they’re going to be able to talk about,” said Berg.

And non-alcohol spirits “are just proliferating like crazy. I see 10 new ones every week, it seems like,” he added.

Another constant is the premiumization of spirits.

In the 52-week period ending Nov. 19, premium, super-premium and ultra-premium spirits comprised 69.1% of retail dollar sales.

Going back a few years, that share has seldom dropped below 68%.

“In other words, this premiumization is really baked in,” said Berg. “That notion that premiumization is dead, going away—not ready to buy into that yet. We haven’t seen any evidence to that.”

Looking ahead on the economic front, NielsenIQ survey data indicate alcoholic beverage consumers tend to be recession-resilient.

Asked how the pandemic had impacted their household finances in the past two years, respondents representing 35% of alcohol beverage dollar sales said things had not changed, and they were spending the same.

Another 8% were termed “Thrivers,” who “had saved money and feel more financially secure.”

(17)