By shaping actions around the activity in the market, we are better able to optimize resource allocations, deliver improved customer experiences and maximize revenue.

We’re 20 years into the SaaS revolution now, and B2B companies have gotten the table stakes of an operational set-up for tactical go-to-market pretty much down. We know how to define our ideal customer profiles (ICP) in terms of firmographics. We understand the importance of

But what if you’re a new company and you don’t have the data you’d need to create an effective model? What if you’re small and you don’t have the resource to get all that groundwork done any time soon? What if you’re in a mature category and you’ve already completed all the set-up work – and all your competition has too? In those situations and more, innovative marketing and sales teams are starting to look at their challenges and opportunities through a different lens. Rather than viewing their ICP targets as lookalike companies who all deserve equal attention, they’re turning to sources of behavioral insight that can illuminate the actual people and real solution needs to focus on now. By shaping their own actions around the activity in the market, they’re better able to optimize resource allocations, deliver improved customer experiences and maximize their revenue.

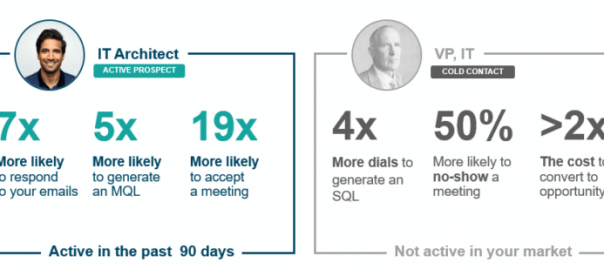

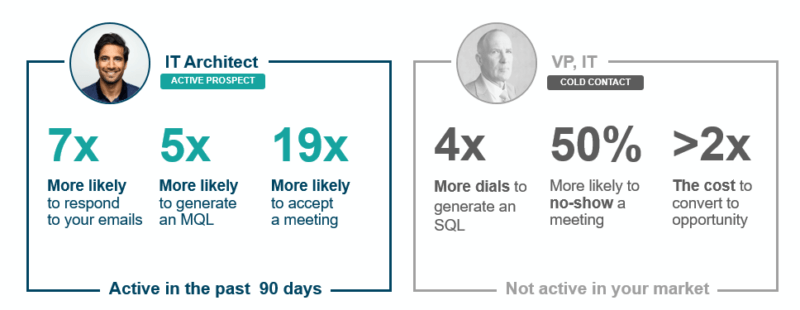

Here’s the proof of why activity matters

When the global

But not just any activity

It’s important to note that the activity we’re talking about here is materially different from three more common sources of behavioral data. First, and most common, are the “leads” you’re already buying or capturing inbound from your website and outbound with your MAP. High-volume leads are typically exhibiting a single consumption behavior in response to a single asset. And even sophisticated scoring efforts, if you’re strict, might include less than half a dozen specific behaviors. As a result, you get a lot more false positives and a lot less productive yield.

Likewise, the activity we’re talking about here is very different from the signals you can pick up about a company or an individual by scraping investment sites like Crunchbase or public relations news about big new deals or personnel changes you might get from LinkedIn. While useful as background for sales call preparation and relationship management, these are neither intense enough nor directionally powerful enough to depend on as drivers of concerted outbound activity. They can’t tell you who exactly is involved, where a buy is coming from now, or what other types of purchases could be coming in the future.

Furthermore, while there are increasingly promising sources of account-level buying signals that can narrow your total target list a great deal, without knowing the specific people involved and the issues at play at a very granular level, you simply can’t target as tightly or message as precisely as is needed to maximize productivity.

How activity matters in sales

When a salesperson has a large territory comprising many accounts, it’s typical to organize them into buckets based on some combination of ICP matching, experience

For field reps with only a few accounts, the value of activity is more subtle, but just as powerful. For a wide range of products, large accounts can typically have many buying centers. But if a salesperson has worked hard on a given account, maybe they’ve even sold a deal, the natural next step is to move on to another in their patch. When they have access to buyer activity data across the whole of the account, they’re able to immediately see demand present in other pockets even though they hadn’t had a chance to personally reach out to that buying center. Now they can make a truly informed choice of whether or not it’s time to move on or to strike while the iron is hot and leverage what they’ve learned into follow-on business.

How activity matters in demand gen

Because they’re often selling low-involvement products, many B2C marketers actually do have the ability to generate demand. As any first-year economics student will tell you – with all else being equal – if you lower the price of a commodity, “demand” for it can go up. B2B is different though. We may call what we do “demand gen” but it’s really about demand identification and demand capture. Unfortunately for all of us (and frankly, for our

Activity-based demand gen turns the table on this. It puts the focus squarely on improving conversion rates through quality interaction. When teams make the switch to activity-based targeting, we see them become much more picky about what they produce and what they invest in. Rather than staying satisfied with hypothetical personas, for example, they start learning all they can about the actual people who are exhibiting buying signals. They begin to work much more closely with their inside sellers to shape cadences more intelligently. They dig into their conversational marketing tools to better address and qualify inbound traffic. And importantly, we see them move beyond output-based KPIs, to focus on opportunity creation, pipeline movement, and revenue yield.

How activity matters in ABM

As we see it, the sole purpose behind investing in ABM programs is to increase the average revenue yield and total profit obtained from a specific set of target accounts. We plan to invest more on those accounts because, by doing so, we intend to get more out of them. We’re making an educated bet that there’s more demand in there than we’ve historically been able to tap into. And to go after it, we know we’ll have to do better at marketing and sales.

A notable difference we’re seeing between practitioners who are lukewarm on ABM and those who are shouting its benefits to the rafters stems in part from the efficiency of, and the scale to which they’ve been able to grow their successes.

The very best teams are starting to move beyond only doing better with a small set of laboratory accounts to measuring success objectives using a completely new type of metric. SiriusDecisions’s “demand unit” concept provides the intellectual groundwork for the evolving approach. Rather than just looking to beat a historically derived account quota, companies are now beginning to try to calculate the real potential of the account more accurately. Then, they’re planning and investing proportionally in marketing and sales based on that potential. Activity-based targeting is making it easier to operationalize advanced approaches like this. Practitioners are using it in ABM to build programs designed to maximize share of wallet yields per account.

Activity demands action

Buyer activity signals – combining what you’re able to capture on your own properties and obtain through third party sources – provide access to a more complete view of total demand activity in a given market category. Capturing this demand requires that you make a concerted effort to go after it. If in the presence of better information, you don’t change your processes, you shouldn’t expect better yields. Furthermore, the more granular and rich the signals’ components, the greater their accuracy will be in pinpointing opportunity and the greater potential that they will offer a guide to modifying your efforts in line with real behavior in the marketplace. The logic of this seems clear: When the task is to close business, it’s essential to listen and respond to what the customer is telling you. That’s how you can deliver better on customer experience.

Marketers and sellers who are succeeding with activity-based targeting are pursuing activity aggressively. They’re throwing out rigid persona concepts to adapt to rapidly evolving buyer researcher types. They’re dynamically adjusting messaging and positioning to reflect how customers themselves view the issues. In sum, they’re becoming smarter, more agile and more customer

Opinions expressed in this article are those of the guest author and not necessarily Marketing Land. Staff authors are listed here.

Marketing Land – Internet Marketing News, Strategies & Tips

(41)

Report Post