Ah, the lowly break-even analysis. Maybe you learned break-even analysis in Accounting class, or Finance, or even Marketing class. Maybe you think it’s so simple, so … pedestrian that it couldn’t possibly provide any value to organizations trying to optimize returns. But, you’re wrong. Break-even analysis is very powerful and should guide your marketing decisions so you can beat the competition and grow your business. Do you know how to use powerful break-even analysis strategies to guide business decisions and explode performance?

If not, read on.

What is break-even analysis?

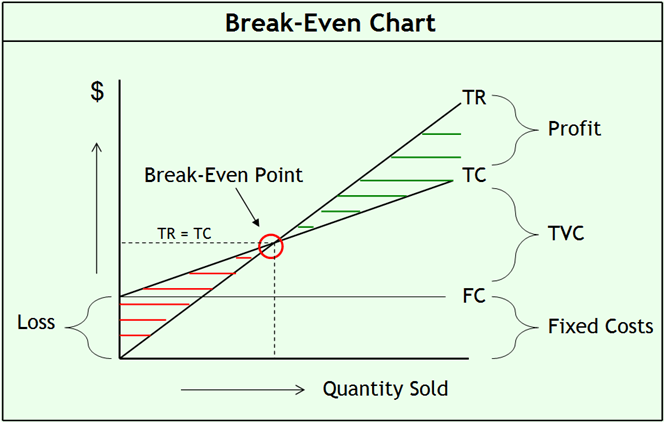

First, let’s start by defining the term break-even analysis for those who might not know its meaning. As you see in the image, break-even is the point at which you start making money. Up to break-even, you’re losing money — which is never a good thing, but unavoidable sometimes.

So, how do you do a break-even analysis?

First, gather all your cost and pricing information.

Your accounting records should have all the information you need to calculate break-even. In addition, you need selling prices, which may vary across different transactions. For instance, maybe you discounted products to get rid of excess inventory or increased your price when a competitor dropped out of the market. You need to know how much volume sold at each price point to adequately calculate break-even.

As we delve into break-even analysis more deeply, you’ll find additional data you need for more sophisticated analyses that make more powerful break-even strategies possible.

Second, divide costs into fixed costs and variable costs.

Fixed costs stay the same regardless of how much you sell. Items such as rent, utilities, insurance, administrative salaries, etc are generally considered fixed. Now, for those of you who want to get a more nuanced view of fixed costs, technically fixed costs stay the same over a certain number of units produced. Eventually, you need a second facility, more management, and utility rates go up. When you graph fixed costs over the LONG-RUN against units produced, you’ll notice that fixed costs stay the same for a while, then jump to a higher level and stay there for a while. Thus, fixed costs OVER THE LONG-RUN for a step function (ie. it looks like stairs stepping up over time).

Variable costs vary directly with the amount of product you produce. Materials, labor, and transportation are common types of variable costs. Even service businesses incur variable costs for things like food for a restaurant, cleaning for hotel rooms, and inventory for a retailer. When you graph variable costs over units produced, you get a straight line with a positive slope (it angles up from the point of origin).

Next, calculate your contribution margin.

Contribution margin is your selling price minus variable costs. Sure, you can just plug these numbers in rather than calculate contribution margin separately but, as we’ll see in a moment, contribution margin is a valuable tool for building better insights to guide better decisions.

Finally, divide your fixed costs by your contribution margin.

You now have your break-even point showing how many units (or $ if you multiply the break-even number of units by average selling price) you must sell to hit break-even.

Easy peasy.

But, that’s NOT very powerful, you say.

And, I agree.

First off, who wants to just break-even.

Secondly, how does knowing this help you make critical decisions that impact your bottom line?

Using break-even analysis for decision-making

Discovering how much you’ll make or lose this year

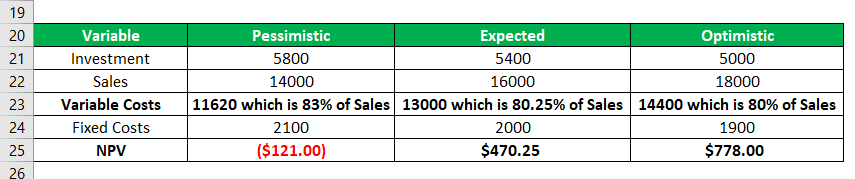

Well, obviously, you can use break-even analysis to discover how much money you’ll make or lose. And, if you’re losing money, you can use break-even analysis to help you make more money. For instance, can you charge more for your products so you at least hit break-even? Can you find less expensive inputs, allowing you to break-even? Adjusting your plans helps ensure you make a profit. Take a look at the example below.

Image courtesy of EDUCBA

In the example above, the business calculated break-even (in this case net present value which is a fancy financial term used to reflect that money you get in the future is worth a little less than the money you spend today). Here’s a quick video for those interested in exploring this topic.

Note that a pessimistic forecast results in a loss while the optimistic forecast generates a pretty good NPV. In bidding on projects, I commonly include something like this so the client can evaluate whether hiring my firm is worthwhile.

Calculating break-even may sound simplistic but I once consulted with a client who had no idea whether he was making money on individual products in his product line. He was a manufacturer and just guessed at how much it costs to make each product in his product line and charged what he thought customers would spend. His profits were declining and we couldn’t even help figure out where the problem was without a major overhaul in his business record-keeping (you need activity-based costing to figure out how much it costs to manufacture each product).

Play “what-if” games using break-even analysis

Well, that’s the secret; doing a powerful break-even analysis capable of guiding decisions. You can now play games with your break-even to improve your ROI (return on investment). We call this sensitivity analysis. This form of break-even analysis allows you to estimate the financial impact of different business decisions.

For instance, what happens if you spend $ 20,000 on advertising? Simple. Add $ 20,000 to your fixed costs and redo the break-even analysis and you now have a new amount of product you need to sell to break-even. Is the proposed advertising worth it in terms of additional revenue from sales prompted by the ad? Now, you have concrete numbers to guide decision-making.

You can use break-even analysis to answer all kinds of questions that aid decision-making across a wide range of situations.

- Will your product hit a target ROI? — Say you strive for a 20% ROI to greenlight a project. Just add that number to your fixed costs and conduct a new break-even analysis. Does the resulting required number of units sold match anticipated sales of the product? If yes, the project is a go; if not, it’s back to the drawing board.

- Should you introduce a new product? Calculate the new break-even with the new product. Be sure to account for any cannibalization of existing brands. Again, does the resulting number of required units sold match projected sales?

- Is it better to offer a discount on your brand or pay a fixed amount for advertising? Just do a break-even analysis for each scenario and compare the outcomes. Or, compare outcomes from several optional strategies. The option with the lowest required number of units sold is your best bet.

- Would the anticipated decrease (increase) in product quality more than compensate for the lower (higher) cost of materials? Again, compare the 2 break-even analyses to see the impact on break-even. Using projected sales for each option, make the choice to go with the best fit.

- Should you make a product from scratch or assemble it from purchased components? Do the break-even analysis twice.

See the power of the lowly break-even analysis?

Caveats for powerful break-even analysis models

While powerful break-even analysis strategies such as sensitivity analysis offer a concrete means to compare proposed strategies, the resulting number shouldn’t make your decision for you, as other factors impact your decision. Break-even analysis is simply the first step in making a decision that also requires intuition, experience, and external information.

Understand consumer responses

Remember, that the true power of break-even analysis relies on having good consumer data. Without accurate forecasts of how consumers will respond to proposed changes, you don’t know whether your new break-even point is attainable. And, without customer insights, it’s hard to know how your changes will impact the long-term relationship with consumers and your brand’s reputation.

Understand competitor responses

When you change something in your strategy, you must anticipate changes your competition makes in response. For instance, if you introduce a new product, can your competition match you quickly or will it take time for them to develop a product to match the benefits provided by your new product?

Or, arguably more importantly, if you decide not to develop a new product because it doesn’t meet your minimum ROI standards or cannibalizes existing products to reduce profits, how will competitors and the market respond? Failing to introduce a new product may mean your existing product loses relevance and becomes obsolete.

Consider Blackberry. At one point, the company made one of the top-selling mobile phones. But, technology changed and consumers increasingly wanted smartphones with all kinds of new benefits, such as internet access, apps, and cameras. Blackberry didn’t detect the change fast enough to stay relevant to consumers in the face of competitors and couldn’t catch up. As of 2016, the company no longer produces devices.

Conclusion

Powerful break-even analysis strategies help guide decision-making, but you should never blindly follow the numbers. The results of break-even analysis act as one input in your decision-making, one you should never ignore.

I’d love your feedback on this post so share your comments and questions in the section below. Also, if you have ideas for future posts, please share them with me.

Business & Finance Articles on Business 2 Community

(49)

Report Post