Written by: Doug Malcom , September 7, 2018

What are you After?

Brand equity is a bit of an elusive term in the CX and marketing research world. When asked what it is, you are likely to get a very different answer depending on who you ask. The guy from accounting is likely to give quite a differing opinion than the gal who coordinates with the ad agency. Common questions being asked when a firm is seeking to measure brand equity:

- How much is my brand name worth to consumers?

- What is my brand premium?

- What is my brand’s equity?

- What aspects of my brand image contribute to my brand equity?

- How much are my brand image elements worth in $?

In this two-part series, we will look at brand equity measurement with a critical eye and point the way to a broader, fuller picture of how to track down this elusive concept. Part One looks at the foundations of how brand equity investigations can go beyond mere tracking studies and be fully, yet manageably performed in the survey research and CX environment to deliver excellent insights. Part Two examines the crucial aspects of the choice processes and the outcomes they produce, which most brand measurement firms get wrong.

Measurement Approach That Goes Beyond Mere Tracking

First, it’s clear there are a wide variety of perspectives on brand equity. A Big Six accounting firm is likely to offer something completely different from what a brand management boutique will. We prefer to take a customer equity perspective as opposed to a firm valuation perspective that you might expect from an accounting firm like KPMG or Arthur Andersen. We are after how much perceived value is seen or felt by consumers that can be derived from the brand and on what dimensions they credit this value. This approach integrates two streams of brand equity research, the consumer psychology work of Keller (1993) and Aaker (1996) as well as the information economics thinking of Erdem and Swait (1998).

Kevin Keller’s work and David Aaker’s writings are quite well known, but information economics offered by Erdem and Swait is less so, and postulates there are a number of important effects and processes in the market based on information. The most central is the presence of informational asymmetry in the market – about some market aspects, the manufacturer knows more than the consumer. In these cases, consumers use brand as a signal about these unknowns. The result is that well-articulated, consistent, credible brands have equity in the market.

We utilize this philosophy in our approach to brand equity. We commonly apply both derived and stated measures of brand equity. Furthermore, we assess the functional image of the brand and understand them as drivers of brand choice, not a flimsy brand rating. With these core elements, clients are empowered with an understanding of how their brand is viewed in comparison to competition, how much their brand is worth to consumers and what drives consumer choice of their brand.

Getting the Big Picture Right

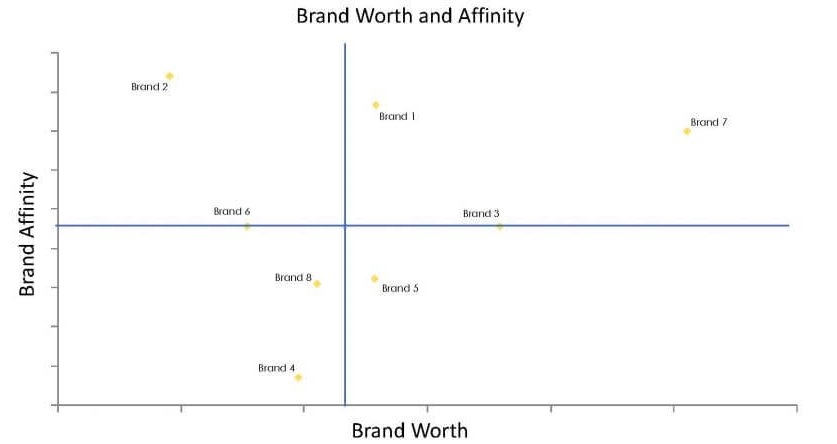

Stated equity measures are often cast as perceptions of brand worthand measures of brand affinity. Worth seeks to quantify how much more a brand is valued by consumers above the typical brand, or how much premium consumers would be willing to spend to get products made by a brand. Affinity metrics are designed to assess the degree of liking, appeal and appreciation that consumers feel toward a brand. These metrics are not left in isolation.

These metrics often fail to inform when left by themselves as barometers or measuring sticks for the overall brand. Ordinarily, all the outcome measures do is populate line charts which show trends over time. We prefer to combine them in a meaningful way, and produce an overall index optimized to the brand idiosyncrasies and particulars of our client and their competitive set.

Getting a Clear Focus on Image

As a researcher, have you ever looked at a funhouse mirror and wondered if something similar is happening in my brand measurement program? A key factor in brand equity measurement is the understanding of a brand’s functional brand image, or how they are broadly viewed on key tangible product performance bases. This would involve measures that center on perceptions of product quality, customer service and support, and category specific measures that affect one’s image of a brand. In measuring the functional image, we avoid the lazy convention of using simple Likert agree-disagree scales in favor of comparative rating scale.

Comparative ratings scales have been found to have better discriminating power and greater predictive validity than other types of attribute rating scales. On a comparative rating scale, a respondent reports whether, for a given attribute, to what degree a brand is better, worse or about the same as other brands. This information gives you everything you want to know about a brand – it directly tells you how the brand compares to the competition. It is a clear and objective scale for respondents to use, which is probably why it performs so well in R&D.

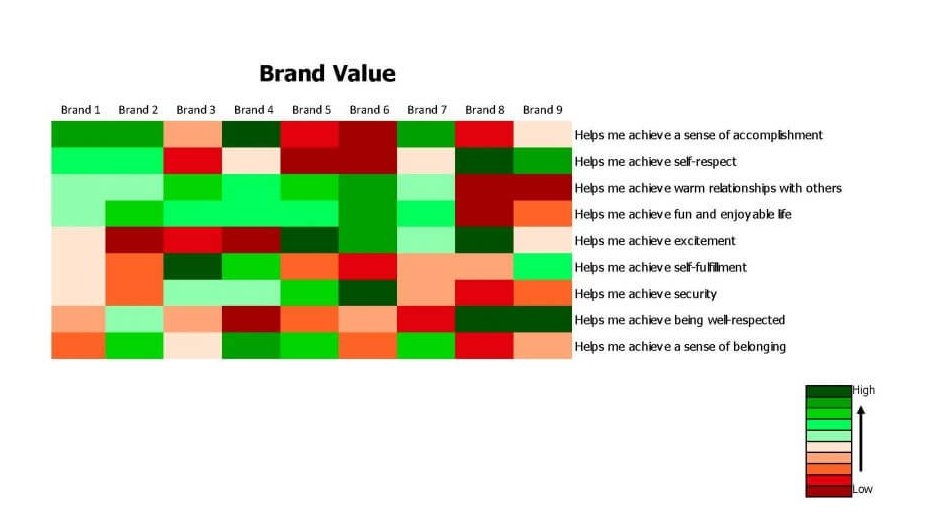

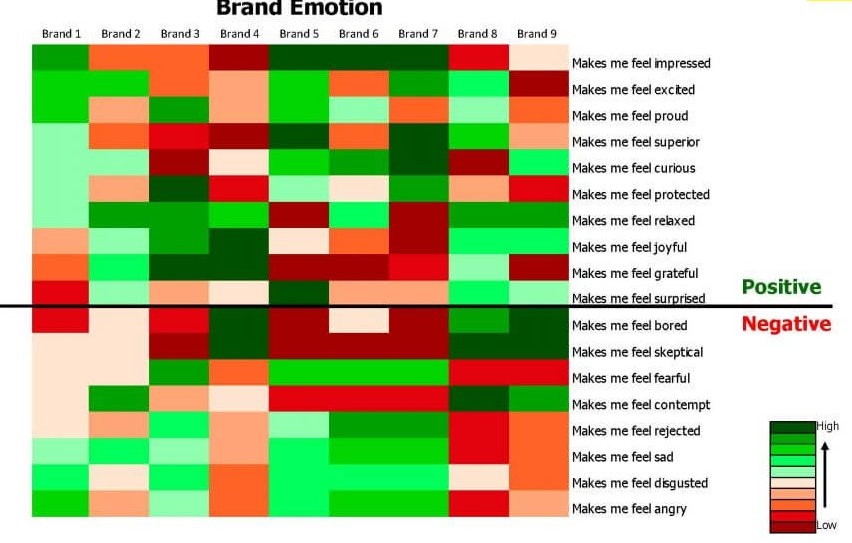

However, we not only want clarity but a broad, holistic view of the brand landscape. Most programs fail to deliver because they only bring insights about the functional image. Our instincts, as well as research on research findings, tell us much more in going on when customers are making brand assessments and choice. Our approach measures not only the harder, functional image but also the softer side in brand image: personality, values and emotions.

By understanding the personality a brand projects, as well as emotions and values it evokes, marketers are much better able to assess where they sit competitively in the market. They are further empowered to assess how well they are delivering on their brand promise and how well they are aligned with corporate strategy.

Looking Ahead: How Better Process leads to Better Outcomes

Now, it’s clear that a proper approach to measuring brand equity involves more than just core metrics that are charted and tracked. We understand much more that the mere functional image of the brand and understand how their brands are viewed compared to competing brands. We also know much their brand is worth to consumers and how well they are liked.

In Part Two, we will hone in on how modeling needs to reflect realistically complex choice processes in competitive context and how these lead to more real-world outcomes than a favorability or liking rating. In the end, we will have a clear picture of brand equity, taken from a broad, comprehensive point of view, one that takes us beyond simple brand tracking.

(50)

Report Post