— September 23, 2017

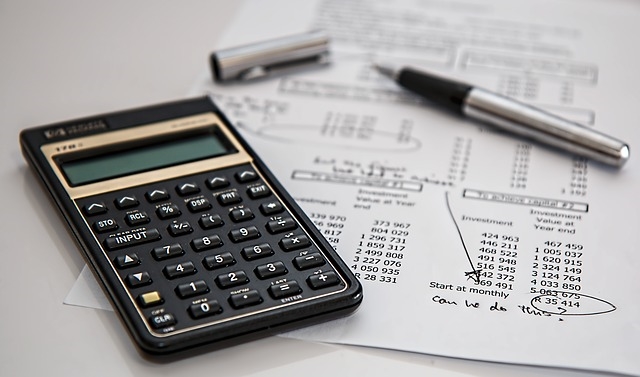

stevepb / Pixabay

FP&A is business lingo for financial planning and analysis. I spent nearly a decade in FP&A teams at large companies, and spent my days reviewing financial data looking for trends and opportunities. No matter the size of your business, this FP&A role is important for long-term growth and success.

However, most startups and small businesses don’t have the ability to hire a full-time financial analyst. If you are a freelancer or a startup founder, you can do your own financial analysis. Let’s take a look at what you should look for in a profit and loss statement, or P&L, when filling your business’s FP&A role.

Get granular with FP&A

Get granular with your review, looking at each product and expense category individually. When you look at your results rolled up to total revenue and expenses, it might hide underlying problems. I keep my books at a very detailed level so I can always jump in and quickly review revenue and expense details.

This is not possible if you don’t keep detailed accounting records. If your books just have one revenue account and one expense account, you hardly know anything outside of total business profits. If you keep granular, detailed accounts, you can find hidden gems of knowledge that can boost your business to new heights.

Turn your P&L upside down

Start your financial analysis with a copy of your profit and loss statement, or P&L. If you use a program like Quickbooks to handle your accounting, you can quickly and easily generate a P&L for any period of time. If you have an accountant, ask for a copy of your detailed profit and loss statement for a financial review.

When you have your file available, start by looking at the bottom and work your way toward the top. Most businesses think of things from the top down, with a primary focus on revenue and a smaller focus on expenses. To get your mind thinking creatively about your finances, start your review with expenses and work your way up to revenue.

Find big wins

In business, we often talk about the “low hanging fruit,” opportunities to get a quick business boost with the least required effort. To find opportunities for a big win, look at the biggest revenue sources and cost centers.

You might find that you have an opportunity to cut a recurring cost, leading to long-term savings. You might find a place where spending a little more can lead to a big increase in revenue. Every business is different, but every business also has opportunities for a big financial win.

Look for major trends

Compare your results to prior periods to identify trends. Major trends can have a huge impact on business results, so look for swings in revenue or costs that appear to be moving in the same direction. Over time, trends can lead to a boom or bust in your business.

Expenses should never trend up faster than revenue unless you explicitly plan for that. Look at revenue trends by product to understand what’s working, what’s failing, and where you and your sales team should spend their time.

Empower your entire team

Few businesses outside of freelancing can stand on one person’s shoulders for the long-haul. If you have employees, co-founders, or co-workers, bring the entire team into the discussion on finances. Show everyone where the money comes from and where it goes. Informed employees are more likely to make decisions to benefit business finances.

Go a step further and empower your team to improve the business’s financial position. Show them the major costs of running the business, and put everyone in a position to help reduce expenses. If you want everyone to have a little skin in the game, you can implement a profit-share or offer bonuses and rewards for helping meet financial goals. Set a high bar for success, you never know what your team will do until they have realistic, measurable goals.

Don’t ignore business finances

Day-to-day business operations may suck away most of your time, but it is imperative for business leaders to make time for finances. At the end of the day, a business can’t succeed if it doesn’t make money. Large companies employ teams of FP&A professionals to ensure they don’t miss the tiny details in the financial results. Your company should give FP&A at least a little attention.

If you take the time to analyze your books, you are taking one more step toward business success.

Business & Finance Articles on Business 2 Community

(107)

Report Post