How do you know if real humans or bots are clicking on your ads? Columnist Soo Jin Oh dives into the results of a test monitoring fraudulent behavior and discusses the takeaways for online advertisers.

The digital advertising industry’s got a big problem, and it’s not going away anytime soon. One report estimated that businesses could lose as much as $16.4 billion to advertising fraud in 2017.

Such frightful statistics are putting advertisers on edge. No business — large or small — wants to see its money wasted.

But how can an advertiser know whether actual humans or bots are viewing and clicking on online ads? How can small businesses understand the complex matrix of ad fraud? And, most importantly, how can they stay one step ahead of fraudsters?

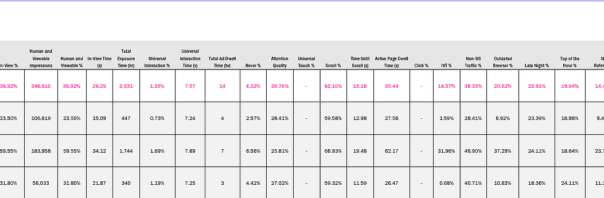

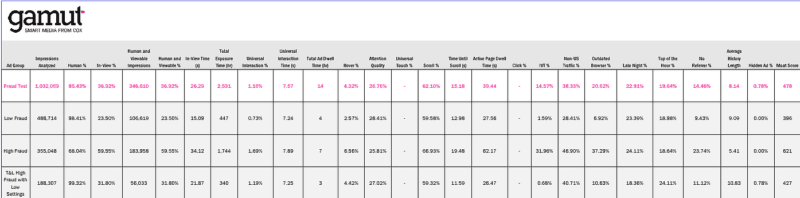

The metrics that might seem indicative of “good” performance at first glance can actually be a hotbed for fraud. As a test, we worked with Moat Analytics, a digital advertising analytics and measurement company, to analyze over a million online ad impressions over the course of a month (September 2017) and monitor fraudulent behavior. We gleaned a number of basic insights about fraud sites that are valuable to any online advertiser.

What puts you at high risk?

In devising our test, we came up with three ad groups. The “low-fraud” ad group used our company’s fraud-block tactics. The “high-fraud” group was the opposite, where we removed all of our fraud-block tactics and targeted sites that had high fraud. The third ad group took the same sites in the high-fraud test and layered in some of our fraud-block tactics.

In our study, predictably, low-fraud ad groups had a high percentage of actual human impressions. However, we found that the high-fraud ad groups had a higher viewability percentage, which means that fraudsters are getting clever and creating fraud where ad buyers are willing to pay a higher premium for viewable impressions.

The takeaway here is that advertisers looking to simply optimize for viewability without fraud filters will be at a high risk for fraud.

Another data point that jumps off the page is that high-fraud ad groups looked to have high in-view time and interaction rates. We can conclude from this that sophisticated fraudster bots are creating faux interactions to mimic real human behavior (e.g., moving the mouse, scrolling a web page). Although their interaction rates are higher, their attention quality, as measured by Moat, is lower than the low-fraud test group. This means that, thankfully, technology is still able to sniff out some fraudster behaviors.

Interestingly, with high-fraud ad groups, an increased percentage is delivered to outdated browsers. This is likely because fraudulent actors are building their technology with older browser versions which won’t be updated to prevent the shady tactics in which they’re engaging. Browser targeting and bid adjustments could be one way to optimize away from fraud.

The high-fraud ad group also saw a 14.31 percent increase in delivery of traffic with no referrer. This is in keeping with previous findings analyzing human vs. bot behavior. Humans most often navigate from website to website, so the chance of referral info is high, whereas bots will not be referred.

Another statistic to consider is “average history length.” Fraudsters have shorter histories. This is a shortcut to recognizing fraudulent activity — bots typically have short lifespans.

So how does an advertiser take precautions with so many bad actors getting so sophisticated? The third row in the chart above is where we layered in a prebid fraud protection program to the same high-fraud ad group settings.

The human percentage jumped significantly, from 68 percent to 99 percent, while in-view percentage dropped from nearly 60 percent to 31 percent. All other interactions became more aligned with what we know of actual human behavior with this filter.

Take steps to avoid online ad fraud

Every online advertiser needs to be aware of their vulnerability to online ad fraud. To avoid it:

- Review your analytics data regularly (keeping an eye on the data points we’ve outlined).

- Partner with sellers focused on eradicating fraud, or hold the sales side accountable when they fail.

- Employ an up-to-date fraud protection technology.

- Keep abreast of the latest fraudster techniques.

Fraudsters are smart, but a cautious, informed advertiser can be smarter.

Opinions expressed in this article are those of the guest author and not necessarily Marketing Land. Staff authors are listed here.

Marketing Land – Internet Marketing News, Strategies & Tips

(39)