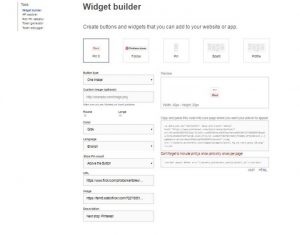

Reddit IPO update: target stock price, shares on offer revealed as NYSE listing date nears

The social media company anticipates a range between $31 and $34 a share in its closely watched initial public offering.

Reddit’s initial public offering is getting closer, as evidenced by the company’s latest filing to the Securities and Exchange Commission (SEC), which has revealed new details about what is sure to be one of the most-watched IPOs of the year. The new filing includes the number of shares that will be made available and their expected price range, among other insights. Reddit had previously announced its stock ticker (RDDT) and underwriters in an earlier filing.

According to the newest details, Reddit will offer 22 million shares of its Class A common stock to the public; 15,276,527 of those shares will be made available by the company directly, and the remaining 6,723,473 shares will be offered by the company’s existing stockholders.

Reddit has also revealed that it expects its Class A common stock will be priced between $31 and $34 a share. However, the company pointed out that it will not receive any proceeds from the sale of the 6,723,473 shares on offer from its current stockholders.

That means Reddit expects it will raise somewhere around $473 million to $520 million for the company in its IPO. Existing stockholders aim to have a combined profit of anywhere from $208 million to $228 million.

With today’s SEC filing, here is the information we know about Reddit’s IPO so far:

- Reddit’s stock ticker: RDDT

- Reddit’s stock exchange: Shares will trade on the New York Stock Exchange (NYSE).

- Number of Reddit shares available: 22 million Class A shares of common stock.

- Reddit’s anticipated IPO stock price: between $31 and $34 per share.

Although no listing date is set, reports suggest the IPO will take place later this month.

ABOUT THE AUTHOR

(5)