The wild growth that Snapchat and other social media companies enjoyed during the lockdown phase of the COVID pandemic is looking farther and farther in the rearview mirror.

Shares of Snap Inc. are tumbling in premarket trading on Friday after the company reported disappointing financial results, missing second-quarter estimates on earnings and revenue, and showing signs of flatlining user growth in North America and Europe.

Snap reported a loss per share of 2 cents, compared to a consensus estimate of 1 cent cited by CNBC. Revenue for the quarter was $1.11 billion, compared to expectations of $1.14 billion, which were already modest. Snap’s average revenue per user was flat at $3.20, far lower than its peak of $4.06 in the fourth quarter of last year.

Notably, Snap also reported a net loss of $422 million, significantly worse than the $152 million it lost in the year-earlier period.

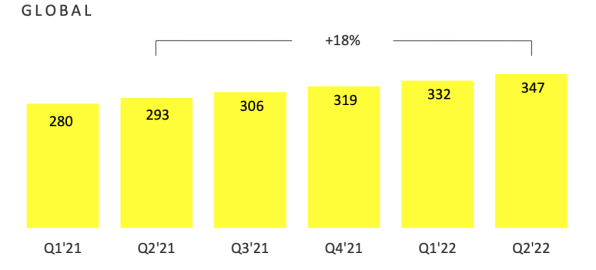

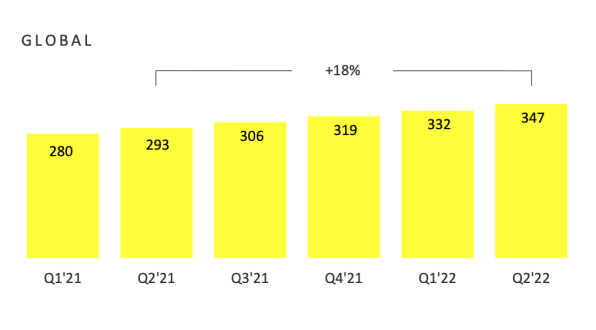

Snap’s global active user base grew to 347 million, beating consensus estimates and representing growth of 18% compared to the same period last year. But much of that growth came from areas outside of North America and Europe, where Snap reported a quarter-over-quarter growth of just 1 million and 2 million users respectively, indicating that its business is maturing in those key regions.

In a statement, Snap CEO Evan Spiegel acknowledged the challenging environment and indicated that the firm would “evolve” some of its business objectives, including heavier investments in direct-response advertising and alternative revenue sources. “While the continued growth of our community increases the long-term opportunity for our business, our financial results for Q2 do not reflect our ambition,” Spiegel said.

Investors were clearly spooked by the news. As of early Friday morning, Snap stock was down more than 30% in pre-market trading. The stock is already down more than 60% year to date.

And other social media companies are feeling the heat too. Meta, parent company of Facebook, saw shares tumble more than 4% after Snap’s earnings release, while Twitter fell almost 3%.

In a way, all of these U.S.-based companies suffer from the same problem, namely TikTok, which has become tremendously popular with younger users over the past two and a half years, and which continues to outpace its more established competitors in terms of user growth. TikTok is owned by China-based ByteDance, which is privately held.

(16)