If you’re anything like me, you’re regretting that you left your 2017 planning so late. It’s already Q4 and you are crazy busy trying to hit what are always the biggest goals of the year, as well as getting your budgets and plans locked in for the coming year.

The inevitable increase in goal means it’s time to capacity plan. This includes building a budget, and a hiring plan. Leaving capacity planning to last minute (a bit like I did with this blog) means you may have lost an opportunity to hire early and get ahead of the curve. There are many factors to consider and you will need data to support and build out of your plan.

The actual math that goes into capacity planning is relatively straightforward. The tougher bit is getting the inputs required to build out a model. I’ll walk you through my step-by-step guide on how I think about doing my capacity planning, starting with the basics before moving into the more nuanced aspects, and how a sales performance analytics solution can help you pull the numbers needed to expedite the process.

Building Your Model Framework: Top-Down vs Bottom-Up

Typically your CEO tells you the number you have to hit based on the growth the business needs to achieve. You go a little pale and then collect yourself and build a plan and a budget based on the resources you have today and what additional resources you need to hit that number. The CFO then says you have half the money you requested to execute on that plan, and then the negotiations start. Oh, the joys of wearing different departmental lenses!

The best way to set yourself up for success in these discussions is to be well prepared with a defendable plan backed up with data. My suggestion is that you build two models and then compare the results.

- Top-Down Approach (quota coverage model): Take the goal and build a model that lists your current team, their quotas and then add (in a staged manner) the famous TBH’s (To Be Hired) to get enough quota coverage to hit the goal.

- Bottom-Up Approach (analytical model): Look at your past performance (actual data), new information pertinent to the coming year, your rate limiting factors, and build out a model to predict how much you can do.

Top-Down (Quota Coverage Model)

This is the simpler approach and used by many sales leaders. There are five key components to consider: hiring capacity, ramp rate, quota attainment, attrition and seasonality.

Hiring Capacity

If you have 10 reps each carrying a quota of $ 50k per month your coverage is:

- Monthly Quota Coverage: $ 50k x 10 = $ 500k

- Annual Quota Coverage: $ 500k x 12 = $ 6m

If your new goal is $ 12m, you need an additional quota coverage of $ 6m, which needs to come from your TBHs. You might think, “Well, that’s easy, I just need to double my team, right?” Not so fast. You’d be foolish to think you can have all 10 start on the first of January. A recruitment plan and process is the topic of another blog, but needless to say you need to think about the resources today you have to support your hiring needs. It is a good idea to set achievable hiring goals and understand how many people you can hire over a specific period of time.

Ramp Rate

Most teams have a quota ramp rate that is more ambitious than what actually occurs. This is dangerous for two reasons.

- You miss your goal

- Your new reps get started on the wrong footing (i.e. failing) and don’t believe the goal is achievable

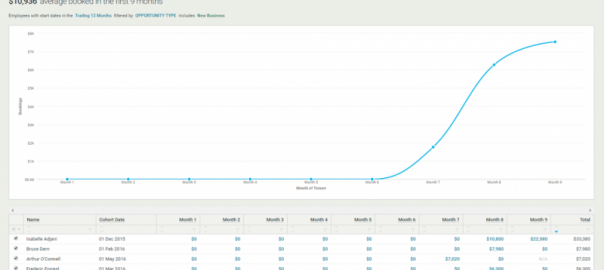

In order to predict more accurately and indeed set more realistic quotas, cohort your new starters and normalize the dates to see how they do in month one through month twelve. This will help you see how they actually ramp. In the analysis below you can see that it took seven months before this group of new employees delivered anything! If you did what many sales leaders do and gave them a three-month quota ramp, you’d be in trouble.

Actual Ramp Rates in MRR

Quota Attainment

As much as we like to think we will have 100% success 100% of the time, that’s just not how it works. A quota coverage model is very sensitive to the assumptions you make around performance against quota. An accurate Quota Heatmap will help make accurate predictions. In the example below, you can see that on average, this team only achieves 54% of the quota roll-up. Assuming 100% success with this team would be fatal. It is prudent to assume a buffer between quota roll up and the company goal. There is no right answer here. I have seen buffers between 15% and 30%, but this is company specific.

Quota Heatmap

Attrition

We all hope we hire right, everyone we hire ramps fast, and they all stay on board. The reality is always somewhat different. People leave, people get promoted / transferred, and people get fired. It’s just that simple. So I caution you to factor in some amount of attrition. I’d suggest working with your HR team to understand the historical data around this. Then, look at your current team and look for reps at risk. I like to use two numbers:

- % for those in ramp: Usually higher as these people are not known and there is more risk

- % for those who are ramped: Usually lower as these people are known quantities

Seasonality

Most companies have some sort of seasonality. This could be unique to your industry, based on the budget / spending cycles of your customers, or could just follow the typical end of quarter spikes—a slower summer and bumpier Q4 pattern. This might be tricky if you have not had enough time to see a pattern, but looking at bookings or billings numbers over the trailing 12 or 24 months will give you a good idea.

Quota Heatmap

Worked Example: Top-Down Quota Coverage Model

- Goal : $ 12m

- Current Reps: 10

- Quota per rep: $ 50k per month (ignoring seasonality for simplicity of illustration)

- Quota to company goal buffer: 15%

- Hiring Capacity: 5 reps per month

- Ramp Rate (by month) – $ 0, $ 15k, $ 25k, $ 35k, $ 50k

- Attrition

- 10% for ramped reps

- 20% for ramping reps

- 10% for ramped reps

Quota Roll-Up Model

As you can see from this image, the number of new hires (those in yellow) is not ten, but actually 30! Much different than what we might have expected at the beginning of this exercise. This model shows a quota roll-up of $ 13.7m. Divide this by 1.15 = $ 12m, which is the goal you need to achieve.

Bottom-Up (Analytical Model)

Ask most sales reps what they need to be successful and the answer is usually “more pipeline!” As opposed to the quota coverage model above, in this exercise, we assume that pipeline, not quota coverage, is a rate-limiting factor. In other words, if we gave the reps more pipeline, they would close more business. In reality, there is a tipping point where a rep is at capacity and cannot handle more pipeline. Other than doing a time and motion study, full capacity is difficult to quantify. Doing both the quota coverage model with the analytical model gives you a good read. Using pipeline as the rate limiting factor, we need to consider the following inputs: pipeline production, conversion rates, sales cycle and average deal size. The analytical model helps identify the key drivers such that goals can be set and monitored for each of the levers.

Pipeline Production

Increasingly, SDRs are responsible for producing pipeline for the AEs. If we work on the basis that 100% of the pipeline will come from SDRs, we need to assess how many SDRs we need and how they produce pipeline. Typically SDRs are given leads from marketing. Looking at our conversion (leads to opportunities to deals) ratios, we can see how many leads we need to produce. In the example below, this company’s marketing team are on fire, with leads converting to opportunities at 91%. Perhaps a little optimistic in the real world!

Lead to Opportunity to Deal Conversion Funnel

SDRs are also managed to a set of KPIs which inform their results. Most teams are judged on the number of outreaches made, typically emails and phone calls. So, we look at the ratios of these activities:

- Call-to-connect ratio 10:1 means I need to make 10 calls to connect to one person

- Connect-to-meeting scheduled ratio 10:1 means I need 10 connects to book a meeting

- Meeting scheduled-to-meetings attended ratio 2:1 means I need to book 2 meetings for one to turn up

- If meetings attended = an opportunity stage one, then in order for a SDR to create one opportunity she needs to:

- Make 200 calls

- Have 20 connects

- Book two meetings

- Make 200 calls

SDR Activity Ratios

If we consider the SDRs to be the producers of pipeline:

- We now know how to set KPIs that will yield a specific number of opportunities per SDR

- We know how many SDRs we have today so using the same logic as the quota coverage model (how many we can hire, ramp, minus attrition), we can predict the number of opportunities we can produce.

Conversion Rates

If we can predict the number of opportunities we can produce, then using historical conversion rates, we can also predict how many deals we can win. In the example below, over the trailing 12 months, this company has a 39% win rate. So if the goal is to win 558 customers, they need to produce 1,445 opportunities

Sales Conversion Funnel

Sales Cycle

Conversion rate is only useful if we factor in time. Using the example above, it’s nice to know I have a 39% win rate, but we need to know how long it takes. This will inform when you need that pipeline to appear. If, for example, your sales cycle was greater than one year, then it’s too late to build a plan now for next year. Warning: be mindful of averages. For both sales cycle and conversion rates, ensure you drill into the detail by region, product, size of deal etc. You may find there are big differences that you need to factor in.

Sales Cycle

Average Deal Value

Understanding the size of your average deal is pivotal to knowing how many dollars each opportunity will produce. It is also important to consider if this has been changing and what you should expect in the coming year. The below example shows a spike in December of 2016. Is this a new normal or simply an outlier? You can use historical data to inform if the average deal value is trending in one direction or another. The objective of this exercise it to agree what you believe it will be for the coming year. Perhaps you are building a sales team that chases bigger deals so you want to show a steady increase over the course of the year.

Average Deal Value

Worked Example: Bottom-Up Analytical Model

- Number of SDRs Jan 1: 8

- Net hiring: 2 per month (takes into account attrition)

- Average number of opportunities per SDR: 10 per month (aggregate of ramped and ramping)

- Conversion Rate: 24%

- Average deal size: $ 20k (increasing at 2% per month)

Analytical Model (SDR Produced Pipeline) as the Rate Limiting Factor

In this exercise, you can see your way to $ 13.8m.

Putting It All Together

Most sales leaders do capacity planning by doing the quota coverage model and hope they can produce enough pipeline to hit the number. Tip: There is no room for hope in sales! The quota roll-up model assumes reps or quota coverage is the rate limiting factor and gives a visual on how many people you need to hire and by when. The analytical model assumes pipeline production is the rate limiting factor and gives you good visibility into all the drivers required to deliver on the plan. Running both models and then comparing them allows you to make an informed judgment on what you believe a doable goal for the coming year is, and will give you more influence at the negotiating table with your CEO and CFO.

Good luck!

Business & Finance Articles on Business 2 Community(294)

Report Post