The Luna Foundation Guard (LFG) has added nearly $ 100 million more to its reserves today after purchasing 2,508 Bitcoin (BTC) as part of its effort to reach its $ 10 billion milestone.

The founder of the project, Do Kwon, tweeted the news a few hours ago and went on to share a detailed breakdown of how TerraUST’s reserves look like following this recent purchase.

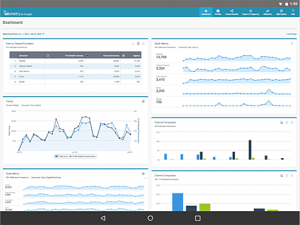

According to the data provided by Kwon, LFG currently owns 42,406 BTCs – a number that can be easily audited by looking at the official BTC wallet mentioned above. This stash is worth around $ 1.7 billion at the moment based on Bitcoin’s trading price this morning and it makes the digital asset the largest contributor to the foundation’s reserves, currently accounting for 75% of the balance sheet.

Additionally, Terra’s reserves are also comprised of $ 398.5 million in USDC – another stablecoin.

Interestingly, the $ 100 million in AVAX coins purchased by the Luna Foundation earlier this month don’t seem to be showing up in this dashboard.

LFG continues to be committed to building $ 10 billion in reserves to back UST – a stablecoin whose value is pegged to that of the US dollar and that is considered the flagship crypto asset powered by the Terra blockchain.

The price of Bitcoin is declining slightly today in early crypto trading action despite this major purchase as LFG appears to have made an off-market transaction that did not affect on the price of the digital asset.

UST Now Available on Binance

Shortly after making this recent purchase public, Kwon retweeted an announcement from Binance where the cryptocurrency exchange informed its community that TerraUSD (UST) will now be listed on its platform.

According to the official press release, Binance will now take UST deposits and users will be allowed to trade the UST/USD and UST/USDT pairs. Additionally, users will also be able to purchase UST via bank transfer, debit card, or wire.

A Closer Look at LUNA’s Price Action

LUNA/USD price chart – 1-day candles with multiple indicators – Source: TradingView

The price of Luna has declined 15.4% so far this year and most of that drop occurred in April following news about the company’s ambitious target of establishing a $ 10 billion reserve to back TerraUST.

Even though the practical use case for this stablecoin has been strengthened, the fact that most of these reserves are in Bitcoin (BTC) makes the value of Luna quite susceptible to the price swings that this other digital asset may experience.

In any case, even though this drop has been quite sharp, the price action remains on an uptrend as indicated by the higher highs and higher lows highlighted in the chart above.

For the time being, momentum indicators are favoring a bearish outlook for LUNA as the Relative Strength Index (RSI) is standing at 42.5 (bearish) while the MACD has drifted to negative territory shortly after moving below the signal line.

Meanwhile, according to algorithm-based predictions from Wallet Investor, the near-term outlook for LUNA is neutral to bearish as well. However, this service is predicting that the price could surge to at least $ 185 per coin a year from now implying a 112.7% gain if that target is hit.

This prediction coincides with that of another third-party forecasting service, Gov.Capital, whose algorithm has forecasted that the price could rise to around $ 182 per coin a year from now as well.

Your capital is at risk.

The post TerraUST Keeps Adding Bitcoin to Reserves to Reach $ 10 Billion Goal appeared first on Business 2 Community.

(37)

Report Post