In the first quarter of 2017, the AppStore and Playstore saw record revenues yet again with a whopping total of $ 15 billion worldwide, representing a year over year growth of 45%.

Add in other online sales and the amount of money being spent is astronomical.

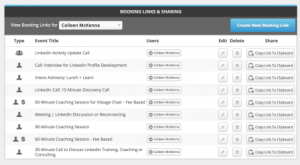

But how do we process all these sales? And what means of processing is best for your company?

We’ve pondered the question and decided to write up our findings. In this article, we’ll compare Stripe, Paypal, Square, and Braintree to see what each do and how they do it. We’ll analyze those findings and suggest which might be better for different kinds of businesses.

The key areas we’ll compare are:

- Features – what do they offer and what can’t they do?

- Pricing – where can we find those small gains which make a difference at scale?

- Ease of use – can a regular person integrate it into their business, or is a developer needed?

But first, let’s look at some of the different use cases for these payment platforms to contextualize our investigation.

When might we need a payment platform?

One of the most obvious times when you’ll consider which platform to use will be when establishing an online business, or transitioning your current business to online sales.

Many digital startups use platforms like WordPress or Shopify for their web presence and online sales. In our article on MVP apps we highlighted the use cases and potential of these products for entrepreneurs starting a business, and a lot of money can be made. Shopify, for example, have a total gross merchandise volume of over $ 40 billion and make enough sales for Shopify to cream off $ 151m per year in revenue.

If you’re starting an ecommerce site, you’ll have to deal with payment methods and you will need to make sure you’re giving your audience the right options to choose from.

You don’t need to be using out of the box software to want to integrate a payment platform. Developers hook up their websites to the APIs of different providers all the time and rely on third parties to manage their payments. Huge digital businesses like Uber and Airbnb rely on the providers we’ll cover.

But there are added elements.

You need to make sure your payment provider gives an adequate range of payment options for your customers. You need to know you can run recurring payments if needed. Do you need to be able to operate an escrow service? Is your payment method going to have to act like a business bank account? What about dashboards to manage payments? Accounting? Legal?

There are a lot of variables to consider.

A lot of use cases.

Fortunately, the market has matured nicely and there are plenty of services which make payment quick and easy for the consumer while also hitting the features you need along the way.

Quick review!

Stripe – An excellent option for a brand new digital startup. Stripe helps you establish the business and grow it.

Paypal – A useful addition to have on your site. It’s 12% of the US market’s preferred payment method. Doesn’t excel in any category, though.

Square – If you’re a small business with both online and offline sales, Square is made for you. They offer a good loans package to companies looking to expand. Be wary of the high transaction rates when your revenue increases.

Braintree – Enterprise customers should navigate here. It provides all the payment services of Stripe while also delivering Paypal and low currency conversion rates. Probably not the option for non-techies.

Payment platform features

Stripe

Stripe is a well known platform and does a lot of the things you would expect.

It accepts the major credit cards and debit cards while also accepting some more obscure forms of payment like:

- AliPay

- Android Pay

- Apple Pay

- Bitcoin

- ACH

I know Apple Pay and Android Pay aren’t exactly obscure, but they are part of the modern payment system which makes payment providers more than simply online credit card readers. The inclusion of Bitcoin shows the edge of this willingness to explore new areas.

Given that Bitcoin is the first cryptocurrency to effectively break into the mainstream, it’s no surprise that companies are jumping on board to try to facilitate payment with it. In our article on organizational structure, we noted that certain innovative companies like Buffer were even paying their staff with it. The question will be whether more cryptocurrencies like Etherium, LiteCoin, or others start being adopted by existing payment platforms also. Only time will tell.

Beyond this, Stripe accepts ACH payments – which might be a novel concept if you’re just starting out. ACH, or Automated Clearing House, is an electronic network for bulk financial transactions across the US. It’s primarily used for large volumes of business transactions all carried out in big batches. Think of a company paying 1000 staff on the same day. Likely ACH.

These additions, Bitcoin and ACH, show the role these payment platforms are taking in the market: they’re looking to do everything. From cutting edge technological changes to servicing huge corporate clients, Stripe and – as we’ll see – Braintree are laying strong foundations.

Stripe are also often commended for their API, which is one of the factors which gave them an early edge over competitors like Paypal. Now, one big area where Stripe seem to be leading the pack is with their value added services.

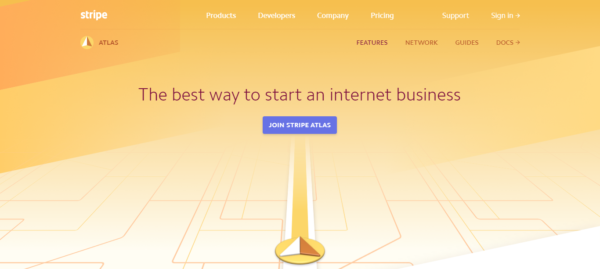

Stripe offer assistance with a whole range of business operations as part of their services. Their Stripe Atlas allows a company (even one outside the US) to incorporate as a US business and provides them with a digital US bank account. They sell themselves on being able to provide this service to companies all over the world, complete in just a couple of days.

If you’ve ever started a business before, you will know how much hassle can be involved. The claim is that they can take all that effort and just standardize the process for you; automating aspects. For a flat fee of $ 500 they offer:

- C Corporation incorporated in Delaware

- Signed Certificate of Incorporation, Bylaws, and Board Consent

- IRS Employer Identification Number (EIN)

- Free templates for common startup post-incorporation legal needs

And also provide:

$ 5,000 of free credits from Amazon Web Services, a free conversation with a lawyer and an accountant, and flat-rate packages for additional legal and tax advice.

All in all, you have to commend them for an innovative onboarding strategy.

Beyond this, they offer the aforementioned legal and accounting services which we’ll give a closer look at later on.

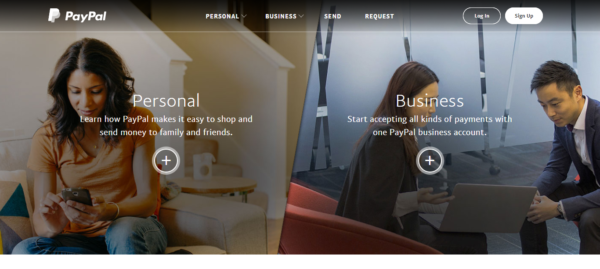

Paypal

Combine Elon Musk and Peter Thiel and what do you get?

Paypal, apparently.

The real innovator in the payment platform game, Paypal, was the company which took digital payment processing mainstream. Since then, the audience for Paypal has grown significantly, and according to the 2016 US Consumer Payment study from TSYS it is the preferred mode of online payment for 12% of the US market.

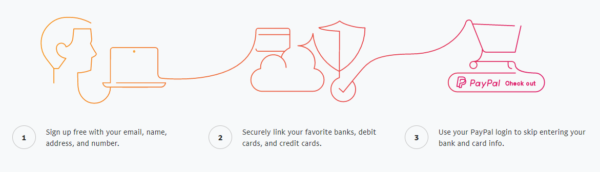

Paypal provides a very streamlined and frictionless payment experience. Simply enter your email and password and you’re able to make a purchase.

This removes having to get your card out and fiddle around tapping in digits, and it also provides a level of security – knowing that you’re not entering your card information into a website you don’t know.

Paypal has a full service approach, giving you the ability to track and monitor your money coming in and out. However, it targets a lot of its business services at small or medium sized businesses while it pushes enterprises over to Braintree – similar to the old relationship between Mailchimp and Mandrill. As a result, the reporting and tracking features may not alway be top of the market.

One area where Paypal are looking to provide added value is in the provision of company loans. Paypal understand your incoming and outgoing payments to some extent and therefore are willing to offer you more money which they think you’ll be able to pay off in future. Paypal are providing loans worth up to 18% of your through-Paypal revenue.

This service may be particularly useful for Paypal’s offline customers who are processing payments through Paypal and want to expand – adding physical space is often harder than adding digital.

It’s a good reason to consider keeping a Paypal portal on your website, at the very least.

Square

This option is a little different to the rest. While Square perform most of the same services as Stripe or Braintree, the real unique selling point of Square is their point of sale (POS) system.

Square sends you a card reader on signing up (contactless readers come at a fee) and provides you with the software you need to manage an offline store. Yes, that’s right, people still use physical shops!

This allows for all your sales, both online and off, to navigate through the same payment platform; making it easier to track and manage your company’s performance. Square accept all the normal credit and debit cards you would expect

They structure their service so that it can manage physical sales of goods and things like professional services.

Their calendar and booking system is geared for service provision, allowing a customer to book and pay online easily and simply. These elements distinguish Square from other providers and open up the potential use cases.

More than this, Square also has added value services geared towards assisting entrepreneurs which are not too dissimilar to the Paypal loans system we mentioned above.

Square offers virtual loans based on your business performance. Considering all your sales activity is being routed through their platform, they are able to leverage machine learning to calculate what kind of loan they could offer you – and that you could afford to pay.

On your Square dashboard, you would be able to click to see if there are loans offered to you. As your business grows, these loans will automatically change to reflect your improved performance. The application takes only a few clicks and, if approved, the money drops into your account on the next business day.

Square then takes loan repayments directly from your sales, so you don’t have to worry about missing payments and risking dropping into hot water. This improves the accounting process and lets small business owners focus on selling and the things they’re good at. You can also pre-pay at no additional cost.

So far, Square claim to have given out $ 1.5 billion in funds to over 130,000 small businesses, with funding amounts ranging from $ 500 to $ 100k.

Like regular loans, but automated and better. A very tempting offer for small businesses.

Braintree

Braintree is very much a Stripe competitor.

First, Braintree bought Venmo, then Paypal bought Braintree. Being owned by Paypal, which is in turn owned by Ebay, has helped catapult Braintree into larger and larger market shares.

In terms of features, Braintree has a number of similarities to Stripe. All the major credit and debit cards, plus:

- Paypal

- Android Pay

- Apple Pay

- Bitcoin

- ACH

- and Venmo

Braintree’s original goal was to have a service which was geared to developers and providing high touch customer support. This has led to its strong performance in the enterprise space, though Braintree works equally well for small businesses too.

Other elements like fraud protection and support for recurring billing all fall under the remit of provided services, too. The fact that they operate in almost double the countries Stripe do gives them an edge, but their array of value added services is lower.

Stripe’s use of business support could put it ahead for startups but with clients like Airbnb and Uber, Braintree still have the edge when it comes to operating at scale.

Pricing

Stripe

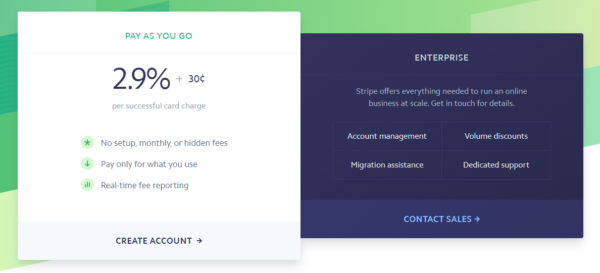

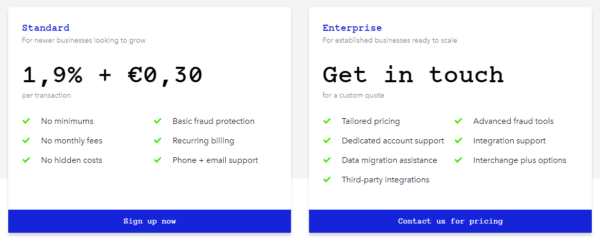

The pricing options for these platforms don’t seem to be much different from one another at first glance. However, when processing large volume, small margins quickly add up.

Stripe charge no monthly fee for their service, instead taking a transaction fee of 2.9% + $ 0.30. The lack of a set monthly fee means you won’t be losing money if you’re not selling, and this flexible model seems to be becoming increasingly prevalent across providers.

When it comes to international sales, however, Stripe charge a 2% conversion fee per transaction. One of the higher rates for currency conversion.

Their rate of $ 15 per chargeback is competitive.

The Stripe Atlas package – to start a new business – costs a flat rate of $ 500 with additional costs for extra services, shown in the image below.

Paypal

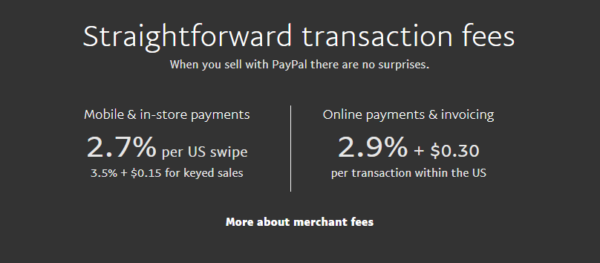

Paypal has three different tiers of pricing, depending on what you’re looking for from the product.

The first tier is based around adding a portal to your website through HTML. This sends your customer into Paypal’s window to complete the transaction.

For this portal, there is no monthly cost and a variable transaction rate depending on your monthly volume; ranging from 3.4% + $ 0.30 for monthly revenues below $ 1500, to 1.9% + $ 0.30 for revenue between $ 15,000 and $ 55,000. Above that, they recommend a custom quote.

The second tier product is an API integration which comes in at $ 30 per month and allows the checkout process to be custom integrated into your website. This requires a custom quote for transaction fees, but we can assume they won’t be a million miles away from the fees listed previously given their advertising copy in the image above.

The final product is aimed at customers who have an existing credit card processing system in place and just want to add Paypal to that. This is a free API access with the same transaction rates as the free portal.

For chip and pin or contactless physical sales, there is no monthly fee and Paypal list the pricing as:

Pay from 2.75% to as low as 1.5% per Chip and PIN and contactless transaction based on your total sales volume.

3.4% + 20p for card payments made by swiping the magnetic strip or manually entering the card details.

Square

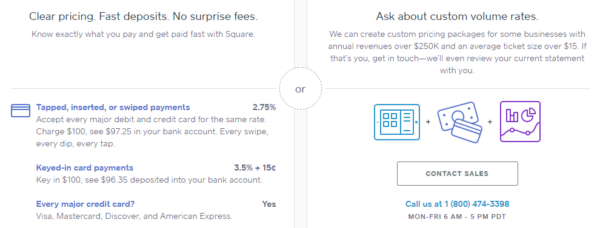

Square’s pricing depends on how you’re paying. There are no monthly fees, but you’ll find transaction costs which aren’t as flexible at scale as other providers.

For contactless payments, you’re looking at a transaction fee of 2.75% with chip and pin at 3.5% + $ 0.15.

Online payments are 2.9% + $ 0.30, which is a fairly standard starting point.

Square sends you a magstripe reader for free, but upgrading your equipment comes with a little add on cost:

- Chip Card Reader: $ 29

- Contactless + Chip Reader: $ 49

- Stand: $ 99

According to calculations done by ValuePenguin, the transaction rates offered by Square are fine and competitive until you’re earning more than $ 17,647 in monthly transactions – at which point another service provider could possibly begin saving you money.

Of course, Square provide software and loans based on your sales volumes through their system, so there is an argument to say that sticking with Square past that point could be a wise decision also.

Braintree

Yet again, Braintree come in at the same price points as Stripe:

- 2.9% + $ 0.30 per transaction as a reported average rate

- No fixed monthly fees

- $ 15 per chargeback

However, Braintree have a couple of distinguishing factors. Remember, they’re geared towards the enterprise market.

Stripe offer discounts for large volume sales, but customers are paying the transaction fees from the first sale. Braintree decided instead to charge no transaction fees on the first $ 50,000 with an advertized 1.9% rate for new businesses.

The real killer, though, is the currency conversion rates. Given that Braintree operates in 45 countries, it makes sense that they would want to try to be more price-friendly to international sales. Instead of matching Stripe’s 2% conversion fee per transaction, Braintree have priced their conversion fee at only 1%.

For an enterprise company with huge volume, that saving of an entire percentage point could prove very lucrative indeed.

Ease of use

Stripe

Stripe make everything easy.

Their Stripe Atlas service is possibly the easiest way to start a US corporation, and certainly the easiest way to do it for a non-US citizen.

Stripe’s additional services like Sigma, which provides an innovative way of tracking your data, and Relay, which lets you sell other people’s products through your app, give business owners the ability to understand and expand their business in ways which are as accessible as possible.

They have integrations for:

Plus a number more. As a result, non-techies can employ Stripe on their websites and small businesses too. Even if the API gives a great degree more custom opportunities…

Paypal

When it comes to ease of use, Paypal has a number of advantages.

It is super easy to set up an account and you can employ it in your website through either HTML or via the API. Additionally, it has a large number of integrations and partners; not limited to:

Given how established Paypal is in the industry, it should be no surprise that almost everything gives you a way to integrate with it.

For small businesses, the UX and UI of the Paypal platform makes it easy to navigate and understand how your business is ticking over. The whole process presents a simple way for non technical folk to engage with it.

Also, it has to be reiterated that Paypal’s OneTouch method is one of the easiest ways to pay available to the end consumer.

Square

Square market themselves to companies which aren’t employing tech to a high level in their business, so it should come as no surprise that they aim for simplicity throughout their product.

The point of sale software is designed to be as easy as possible for a user as the staff who interact with it will be waiters and shopkeepers, not developers.

Square’s Retail product is a little more complex, as it provides essentially a CMS for running your entire operations. Think managing inventory, vendors, and wages. This doesn’t strictly come under the payment processing but does add another extra service to help you manage the flow of your business.

Square integrates with:

- Quickbooks

- Vend

- TouchBistro

- WooCommerce

- IFTTT

- and more.

Braintree

Given that Braintree are geared towards enterprises and developers, ease of use may not score highly.

However, it depends on what we mean by ease of use. With the other examples, I’ve focused on getting started or how accessible it is for business owners looking to transition to digital. With Braintree, it’s probably best to think about the complex heavy lifting it is capable of doing simply – even if that involves some dense code.

Braintree accepts payments in 130+ different currencies so that certainly makes things easier for your business!

For native mobile integration, it also gives you not just the ability to customize the UI of the checkout experience, but assistance in doing so. Developers may want to check out their Custom UI, Hosted Fields, or their DropIn UI for a streamlined way to integrate the payment platform stylishly into your application.

The control panel gives you complete oversight over what is coming in and out, with the ability to create webhooks to deliver notifications regarding certain activities.

Braintree can still be integrated with:

As far as ease of use goes, as long as you have a dedicated developer on staff then the platform can give you everything with no problem.

Which payment platform is right for your business?

Stripe is a great option for a range of use cases and the API allows for a well customized ecommerce process. Stripe is not great for companies looking to make offline sales or companies that want to accept Paypal through the same system. Stripe is a very powerful solution to many business needs and could be a very good option for a new business just starting up and wanting an infrastructure in which to scale. This is particularly true if you want to operate as a legal business entity in the US, and you’re based abroad. For me, this is one of Stripe’s huge selling points.

Paypal is a full payment platform which accepts payments online and off with a much more frictionless experience for the customer. However, only 12% of people in the TSYS study cited it as their preferred payment option. Paypal is willing to support businesses who use its payment service, so it is wise to have it as an option on in your business, yet I doubt I would recommend unless you’re looking for the simplest option.

Square provides similar services to Stripe and Braintree but is a little less cost effective at scale. Where Square excels is in offline sales – it’s POS software is a powerful tool. Square is a very good option for a small business which has an offline and online component, so all payment processing can be centralized. For this kind of small business, I certainly advocate for Square.

Braintree has almost all the features of Stripe but available to 45 countries instead of Stripe’s 25. Being part of the Paypal network adds an additional benefit by opening up a further 12% of the market’s preferred payment method. Braintree is likely the best option for an enterprise company as evidenced by counting Uber and Airbnb as its customers. Braintree is an overall great option and other than the administrative help Stripe give customers starting a new business, Braintree may in fact edge ahead of Stripe overall.

Our recommendations?

Ultimately, it depends on the needs of your business.

Braintree for Enterprise, Square for existing physical outlets, and Stripe for brand new startups.

That’s my summary. What’s yours?

Have you played with these different services? Maybe you’ve implemented more than one? Let me know your experiences with them in the comments!

Business & Finance Articles on Business 2 Community

Author: Adam Henshall

(180)

Report Post