It’s natural for companies to think about acquisition when they think about growth. Certainly in recent years, with capital readily available, growth strategies have revolved around increasing market share at all costs. Working out how to monetize these customers came later.

But acquiring new customers is expensive. As investment opportunities have dry up, it has become imperative that SaaS companies start to concentrate their efforts on reducing cash burn and building companies with healthy economics and an emphasis on efficient growth.

To do this, companies have to focus on lean revenue. And, one of the best ways to achieve lean revenue is to synchronize your sales and customer success teams to maximize the value every customer gets from the product through upsells.

The Importance of the Upsell

In SaaS, revenue can come from two sources: new customers or existing customers.

Revenue coming from new customers can be classed as expensive revenue. There are substantial costs incurred when acquiring new customers: marketing campaigns, sales teams, engineering overhead and commission all have to be paid for to get customers through the door.

Existing customers have already been through the initial, expensive funnel. Therefore these are the most profitable customers, as they require far less sales and marketing expense. Existing customer revenue comes from two main sources:

- Renewals: SaaS services are intended to be used for a long time period. Whether a company is tied into a 1-year or a 5-year contract, high renewal rates should be a focus for any company wanting to make substantial profits.

- Upsells: As a customer uses your service over time, they should be able to unlock further value. This can come from expanding their own company, or seeing more potential in your service than they originally found.

How much more expensive is acquiring new customers compared to retaining or expanding existing customers? In their annual SaaS benchmarking survey, Matrix Partners and Pacific Crest Securities looked at the customer acquisition costs (CAC) needed to acquire $ 1 of annual contract value (ACV) for new customers, upsells to existing customers, and renewals for existing customers:

Source: 2015 Pacific Crest SaaS Survey- David Skok

These results show how much more expensive new customers are than existing customers. The median CAC for $ 1 of new ACV was $ 1.18. This means that it would take a company more than a year to earn back the costs of acquiring new customers. The median CAC per $ 1 of upsells was $ 0.28, about 24% of the cost to acquire each new customer dollar. The payback period for upsell revenue is only about one quarter, almost a year less than for new customers.

As expected, renewals are cheaper still with a CAC of just $ 0.13, or 11% of that needed to acquire each new customer dollar.

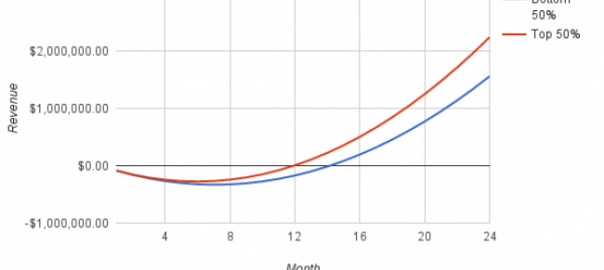

That difference in CAC per dollar makes a substantial difference to the cash flow trough. In this scenario a company is gaining revenue continuously from either new customers with a CAC of $ 1.18, or from upsells with a CAC of $ 0.28:

Revenue from New ACV vs. Upsell ACV

Source: 2015 Pacific Crest SaaS Survey) – David Skok

Here we can see what a difference $ 0.90 makes in terms of the payback period.

If revenue is coming only from new ACV, customers that have cost $ 1.18 to acquire, the payback when constantly acquiring stretches beyond 2 years. When the cost of acquiring $ 1 ACV is less that a dollar, as in the case of upsells, then the compounding quickly starts to work in your favor. Here the payback period is only 6 months even when you are constantly adding (or expanding, in this case) new customers, and with a CAC of substantially less than the value of the customer (ACV in this case), the company continues to see considerable growth thereafter.

Top Companies Succeed By Capitalizing On Existing Revenue

The graph above may be from an idealized scenario, but the top companies are succeeding at building profitability through upsells. The Pacific Crest survey found that, while the median percentage of new ACV from upsells as 16%, the largest companies were substantially above this threshold:

Regular vs. 10% Shorter Sales Cycle

Source: 2015 Pacific Crest SaaS Survey – David Skok

These larger companies are relying more heavily on upsells, and have been consistent throughout the years the survey has been conducted. The companies in the $ 40MM-$ 75MM bracket were gaining the most from upsells, with double the median. This makes sense as these companies will still have room to grow through customers that haven’t yet released the full potential of the service. The number drops slightly for the very largest companies as they may have already explored most upsell opportunities.

The survey also segmented the results by growth velocity. Here an obvious trend emerges:

What Percentage of New ACV is from Upsells to Existing Customers?

With the exception of one category, the fastest growers are adding more new ACV from upsells than the slowest. This shows how important lean expansion revenue is to escape the cash flow trough and start growing fast. If you look back to the “Revenue from New ACV vs. Upsell ACV” the fastest growth companies are exactly the ones on that upward red-line trajectory, out-growing and out-pacing the companies that are still spending too much acquiring entirely new customers.

The survey noted an interesting change in the 2015 results compared to the 2014 results. In both 2014 and 2015 the fastest growing large companies were acquiring more new ACV from upsells than the slower growing large companies. However in 2014 there was no difference in the amount of new ACV from upsells in the fastest and slowest growing small companies. This has now changed, with even smaller companies seeing the gains available from upsells, and reaping the benefits for faster growth.

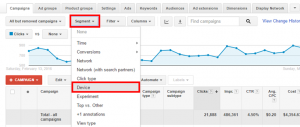

If we take the percentages from the largest companies and use them to calculate payback periods, again we can see the difference upsell ACV can make:

Revenue from Bottom 50% vs. Top 50%

Source: 2015 Pacific Crest SaaS Survey) – David Skok

With only 10% more revenue coming from upsell ACV the top 50% fastest growing companies clear the cash flow trough months ahead of the bottom 50%. Over time, the difference between the two widens as the top 50% fastest growers compound the gains made by low costs on upsell ACV.

In short, with upsells they grow faster and make more money.

How To Make Upsells Your Long Term Focus

This should all be enough to convince you that if you want to grow fast and increase revenue you need to increase your ratio of upsells. But that is easier said than done. Just because it is cheaper to acquire revenue through upsells doesn’t make it trivial.

As Allison Pickens, VP of Customer Success & Business Operations at Gainsight, says “it takes a village to renew and upsell a customer.” It requires a team effort, synchronizing your sales teams and customer success teams to make sure your customers are always using your service to its full potential. Here are four ways sales and customer success can maximize the likelihood of upsells in your organization.

New Sales

New customers are expensive, but existing customers come way of new customers—you can’t have the former without the latter. And to turn expensive revenue into lean revenue, customers need to be successful immediately. That means from day one sales reps need to assess the renewal and expansion possibilities for any of their prospects. If this isn’t a priority for a sales team then they can be acquiring the most costly of revenue: non-profitable revenue. These are companies that are badly qualified and that aren’t going to have success with your product. They’ll churn at the first possible moment, possibly never even escaping the payback period and remaining an outright cost.

This is one of the first points where your sales and customer success teams can work together. Using their knowledge of current successful customers, customer success managers can spot bad deals before they happen and notify the sales team that a prospect fits this specific profile.

Expand within the team

This is all about demonstrating constant value. If a customer is successful, they’ll want more, so upselling within a team is all about making a customer successful. Customer success can try to find out what other solutions the team uses and whether there is an avenue for offering a complete solution to that team. If something is stopping an expansion, then identifying early whether it is price, product, or training that is preventing the upsell helps the sales team find the right solution and helps the customer be more successful in the long term.

This is why customer success is vital to the upsell sales process. Customer success isn’t just reactive, its proactive. The best customer success teams aren’t waiting for problems to solve, they are out interacting with customers proposing solutions and finding out what customers truly want and truly need. With their extensive knowledge of the customers they can then circle back to the sales department and tell them exactly what a customer is missing and what they would benefit from. Suddenly sales knows exactly what to pitch and to whom.

Expand within the company

If a customer is successful, you will have an active supporter in the organization and therefore can start to look to develop further relationships in the company. This requires a customer success manager who is proactive, looking for how they can help the company beyond the immediate person or team they are working with (while continuing to make them successful).

An important part of this is understanding how to segment customers. Just because the team you are working with finds success in your product, doesn’t mean the rest of the company will. You have to understand the whole company, the challenges of each separate department, and where your solution can fit into each. A good customer success team will always be looking for these opportunities to develop further upsells and feed back the best information to the sales team.

Expanding outside the company

Advocacy doesn’t end at the company gates. One way to drive down the cost of expensive revenue from new customers is to have existing customers acting as your marketing team. This could be through:

- Referral. Word of mouth is easily the best marketing channel. If a customer is successful, they will happily tell all their SaaS friends about you, cutting down on the CAC for those customers. Of course, the opposite is also true. Horror stories about your product or team will just as easily spread through the SaaS ecosystem.

- Testimonial. Using success stories from current customers for case studies allows you to operationalize these positive references. Videos, ebooks, or articles showing how similar customers have succeeded with your product makes the lives of your sales and marketing teams much easier.

By enabling success, customer success can transform these customers into empowered advocates that make it easier for sales and marketing to perform with future customers.

Existing customers are cheaper than new customers. This isn’t news. But it’s important to truly understand how much of a difference these costs can make to your bottom line and your growth. Emphasizing expansion revenue, lean revenue, within your company will allow you to not only grow faster and increase revenue, but it will be on the back of making your current customers more successful. This, in turn, will lead to reduced costs for new customers through referrals and easier sales.

This positive feedback loop is built on committed customer success and sales teams, that are partnering to bring the most out of customers, making them successful, and making them want your product more and more each day.

Business & Finance Articles on Business 2 Community(125)

Report Post