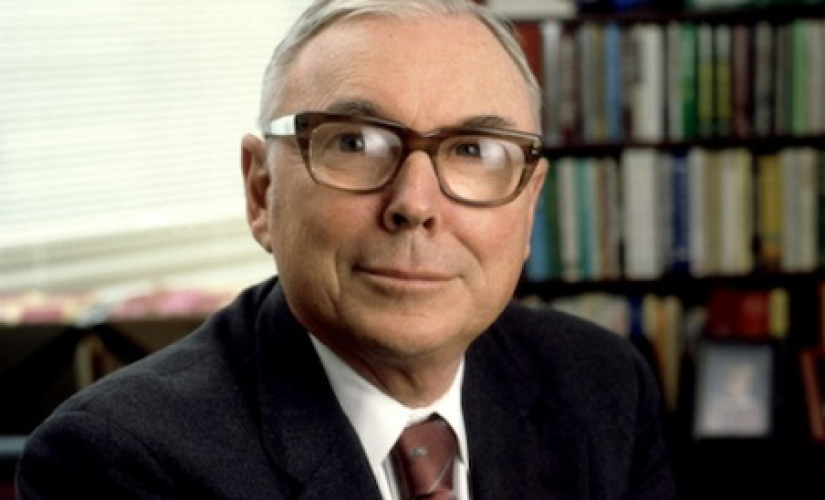

The Life and Legacy of Berkshire Hathaway’s Charlie Munger

Charlie Munger, the man who helped Warren Buffett build Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) into one of the largest companies in the world, died on Tuesday in California at the age of 99. He would have turned 100 on Jan. 1.

“Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in a statement.

Munger grew up in Omaha, Nebraska, and actually worked at a grocery store owned by Buffett’s grandfather as a kid. However, the two legendary investors did not meet until 1959 at a dinner when Munger was back in Omaha to attend to matters related to his recently deceased father.

Prior to that, he had attended the University of Michigan, served in the Army Air Corps, and graduated from Harvard Law School. In 1962, he moved to California and founded a law firm, Munger, Tolles, and Olson, and spun off an investment firm, Wheeler, Munger and Co.

In an article he wrote for Columbia Business School Magazine in 1984 called “The Superinvestors of Graham-and-Doddsville,” Buffett highlighted Munger’s track record running the portfolio at Wheeler, Munger.

“I ran into him in about 1960 and told him that law was fine as a hobby, but you can do better,” Buffett wrote of Munger. “His portfolio was concentrated in very few securities, and therefore, his record was much more volatile, but it was based on the same discount-from-value approach. He was willing to accept greater peaks and valleys of performance, and he happens to be a fellow whose whole psyche goes toward concentration.”

As Buffett pointed out in the piece, Munger’s portfolio had an average annual return of 19.8% from 1962 to 1975, compared to the Dow Jones Industrial Average’s gain of about 3% per year.

Sometime around 1976, Munger joined Buffett at Berkshire Hathaway, and in 1978, he became a vice chair, a position he held until he died. Incidentally, Berkshire Hathaway’s portfolio has posted an average annual return of 19.8% per year from 1965 through 2022, compared to the S&P 500’s 9.9% annual return over that same period.

The wit and wisdom of Charlie Munger in Buffett’s own words

When talking about Berkshire Hathaway and their strategy, Buffett typically says “Charlie and I,” which shows just how close a partnership these two men had. In the 2022 annual shareholders’ letter, which came out this past February, Buffett did it multiple times. Among the many references, Buffett wrote, “Charlie and I are not stock-pickers; we are business-pickers.”

In fact, Buffett credits Munger with refocusing his investing strategy early on in their partnership, as he told CNBC in 2016.

“He weaned me away from the idea of buying very so-so companies at very cheap prices, knowing that there was some small profit in it, and looking for some really wonderful businesses that we could buy in fair prices,” Buffett told CNBC.

In the last letter to shareholders released in February, it was fitting that Buffett offered a tribute to Munger in a section called, “Nothing Beats Having a Great Partner.” You can find it on Berkshire Hathaway’s website, but it seems appropriate to recount here today.

“Charlie and I think pretty much alike, but what it takes me a page to explain, he sums up in a sentence,” Buffett wrote. “His version, moreover, is always more clearly reasoned and also more artfully — some might add bluntly — stated. Here are a few of his thoughts, many lifted from a very recent podcast:

- The world is full of foolish gamblers, and they will not do as well as the patient investor.

- If you don’t see the world the way it is, it’s like judging something through a distorted lens.

- All I want to know is where I’m going to die, so I’ll never go there. And a related thought: Early on, write your desired obituary — and then behave accordingly.

- If you don’t care whether you are rational or not, you won’t work on it. Then you will stay irrational and get lousy results.

- Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.

- You can learn a lot from dead people. Read of the deceased you admire and detest.

- Don’t bail away in a sinking boat if you can swim to one that is seaworthy.

- A great company keeps working after you are not; a mediocre company won’t do that.

- Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.

- Ben Graham said, ‘Day to day, the stock market is a voting machine; in the long term, it’s a weighing machine.’ If you keep making something more valuable, then some wise person is going to notice it and start buying.

- There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.

- You don’t, however, need to own a lot of things in order to get rich.

- You have to keep learning if you want to become a great investor. When the world changes, you must change.

- Warren and I hated railroad stocks for decades, but the world changed, and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.

- Finally, I will add two short sentences by Charlie that have been his decision-clinchers for decades: ‘Warren, think more about it. You’re smart, and I’m right.’

And so it goes. I never have a phone call with Charlie without learning something, and while he makes me think, he also makes me laugh.”

Buffett concluded the segment by writing: “I will add to Charlie’s list a rule of my own: Find a very smart high-grade partner — preferably slightly older than you — and then listen very carefully to what he says.”

Published First on ValueWalk. Read Here.

Featured Image Credit: From Twitter; Thank you!

The post The Life and Legacy of Berkshire Hathaway’s Charlie Munger appeared first on ReadWrite.

(15)