There’s a lot to pay attention to when measuring the growth trajectory of your SaaS business. Are you increasing LTV while keeping CAC down? Is your customer acquisition rate greater than your customer churn rate? Do you distinguish between monthly recurring revenue and committed monthly recurring revenue?

Answering these questions is no easy task–SaaS metrics are extremely nuanced, and it can be hard to figure out exactly how to get the most complete and realistic understanding of your company’s growth, even if you have a few Harvard MBA’s on hand to model everything out.

Here’s why it’s important to bring SaaS reporting into your everyday operations, and how to do it in a way that will help accelerate growth and maximize retention.

The Need for New KPIs

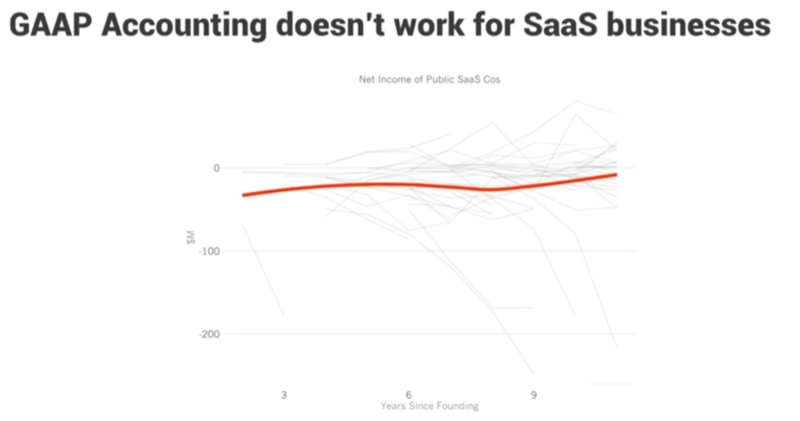

The generally accepted accounting principles (GAAP) used for many businesses don’t work well for SaaS. In fact, if you try to use them to calculate net income for SaaS businesses, the averages come out negative. This negative net income doesn’t change regardless of how old the company is (below).

Does this mean all SaaS businesses are slowly dying? Not at all. It just means that because of how the SaaS business model is built, often revenue and expenditures are misaligned. Companies have to spend money to acquire customers, but over time these customers will bring profit to the company and keep it growing. To understand how SaaS business metrics work, they need to be viewed using a slightly different lens.

Because of the subscription-based nature of SaaS, customers must choose to continue using the service after a pre-determined period of time. This means SaaS company leaders are focused not just on building software and selling it, but serving and supporting their customers over time.

As a result, SaaS businesses must:

- Invest incredibly heavily in customer success

- Invest in post-sales customer service

This greater focus on renewal and customer attention in SaaS means that SaaS businesses need a special set of KPIs to understand important questions like:

- How our business is doing?

- Is our business healthy?

- Are we growing too fast and are we retaining customers well?

What do we want out of these KPIs

SaaS companies run like a car: it’s easy to step on the gas and increase your growth, or step on the brakes and slow down, you just need to know when to do which.

That’s the importance of SaaS KPIs. They can give SaaS leaders an accurate look at how the company is doing. If capital is readily available, leaders know they have the resources to finance growth and can turn up the dial. But if the markets change or your company is not able to make up for losses, then it’s time to dial back on growth.

In this article we’ll answer the two most important questions of any SaaS business:

- How much money are you making? To answer this, we’ll look at how SaaS business measure revenue.

- How happy are your customers? Your customers are your source of revenue, so we need to look at ways to measure customer retention to determine happiness.

How SaaS Businesses Measure Revenue: MRR/ARR

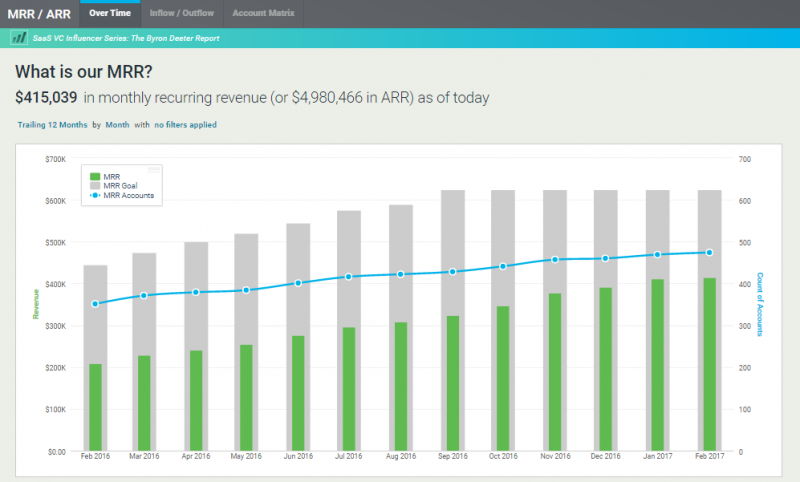

Monthly recurring revenue (MRR) or annual recurring revenue (ARR) are the most widely used measures of revenue for SaaS businesses. Because most SaaS customers pay on a monthly or annual plan, businesses need to keep an eye on how much money they’re bringing in during each pay period.

MRR/ARR are widely used for a number of reasons:

- They’re a reliable, predictable measure of revenue. Each is easily calculated as a simple sum of how much customers are paying each pay period.

- They should be growing over time. Ideally you’re constantly making money, so your MRR/ARR is increasing every period. If it isn’t or it starts to go stagnant, then you know you need to look into why.

- They can be measured against a goal. Often companies will set themselves a goal to hit every year in terms of MRR or ARR. These goals can help make sure you’re on track and growing at a rate that is sustainable.

Your MRR/ARR Over Time report is an easy way to keep an eye on your revenue trend over time. You can see how much your MRR is growing in both revenue and number of accounts, as well as how close you are to reaching the goal you’ve set for the month. In this example, we can see that the company has an upward trend of MRR growth, but still needs to increase their MRR more to reach their goal.

Understand your MRR Better with Your Quick Ratio

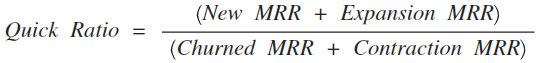

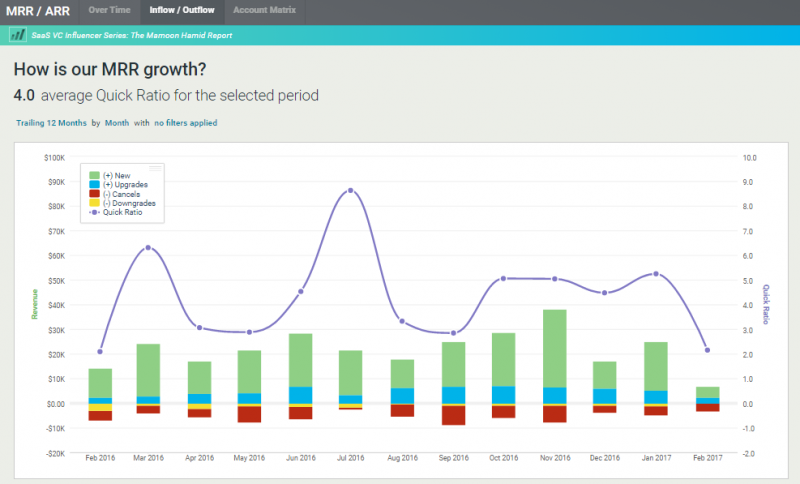

Another crucial metric to monitor when considering MRR/ARR is the Quick Ratio. This ratio was introduced by venture capitalist Mamoon Hamid and is a measurement of how well a company can grow recurring revenue while taking into consideration account churn.

If a company can rapidly scale revenue, but also has a high customer churn rate, then their quick ratio will reflect that. This ratio is applicable regardless of size or age and provides a benchmark for companies to compare themselves to others. By comparing your quick ratio with other companies you can determine things like:

- What is the momentum of your business? If your quick ratio is on the rise or remaining stable, this means you’re keeping a good momentum.

- How well are you retaining revenue? How well are you upselling and expanding revenue? If the numerator of your quick ratio is growing that means your revenue is growing. It’s important to keep increasing revenue to counter any MRR that is lost to churn.

- How are you handling churn, and are you losing more customers can you can bring on? If your quick ratio starts to dip it may be due do a loss in revenue but even more likely it’s because you’re losing customers. By curbing churn, you can work on making the best of any new customers you bring on.

If a company can rapidly scale revenue, but also has a high customer churn rate, then their quick ratio will reflect that. This ratio is applicable regardless of size or age and provides a benchmark for companies to compare themselves to others. By comparing your quick ratio with other companies you can determine things like:

- What is the momentum of your business? If your quick ratio is on the rise or remaining stable, this means you’re keeping a good momentum.

- How well are you retaining revenue? How well are you upselling and expanding revenue? If the numerator of your quick ratio is growing that means your revenue is growing. It’s important to keep increasing revenue to counter any MRR that is lost to churn.

- How are you handling churn, and are you losing more customers can you can bring on? If your quick ratio starts to dip it may be due do a loss in revenue but even more likely it’s because you’re losing customers. By curbing churn, you can work on making the best of any new customers you bring on.

Your MRR/ARR Inflow/Outflow report shows your Quick Ratio over a specified period of time including how it’s changed and the average ratio over that period. Companies that can hit a 4.0 or better quick ratio, like the one in this example, are ones that Hamid feels comfortable investing in. This means they’re adding revenue at four times the rate they’re losing it, which makes for a very compelling growth story and shows clear mastery of the sales process.

One important thing to keep in mind about the quick ratio is that at first it’s easy to keep your ratio high by adding revenue. But once companies reach a certain size, it becomes less feasible to continue adding revenue at a rate that keeps their revenue at 4.0. That means the focus needs to shift from ramping new MRR growth to reducing churn.

To monitor your churn you’re going to need the right SaaS metrics to measure that. There are three different metrics that can help measure customer retention, and in turn customer churn, each that monitors a slightly different aspect of your business.

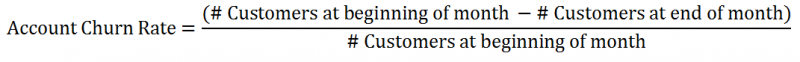

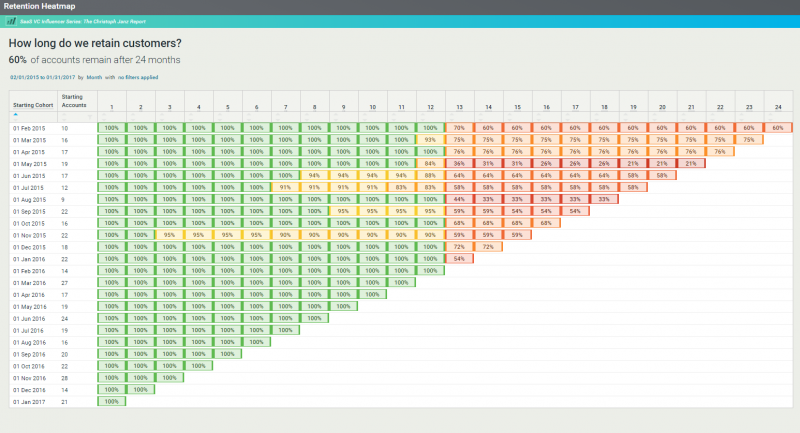

Retention Metric #1: Account Churn

Account churn, also called logo churn, is a measure of how many accounts your company holds.

Account churn is useful because it gives a very black-and-white number of what percentage of customers are leaving you. It takes away the bias from larger accounts so that you aren’t left with one large customer paying for all of your revenue — which is a dangerous situation to be in.

Your Churn Rate: Account Churn report can give you a monthly breakdown of your account churn over time. Ideally, you want to keep your account churn as close to 0% as possible. In this example, the company experienced 2.3% average churn in the past year. That means they lost 2.3 companies for every 100 they started with at the beginning of the period.

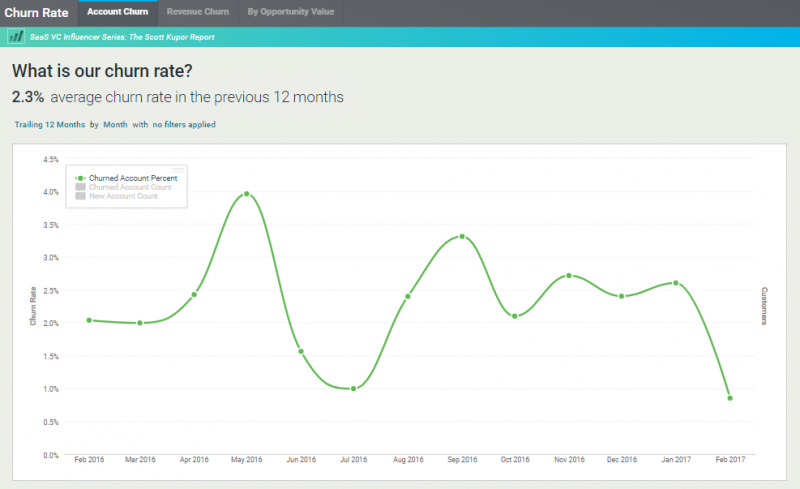

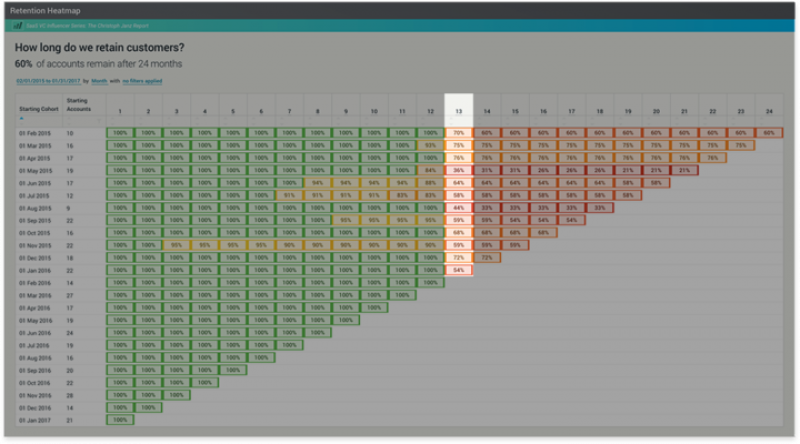

Dig Deeper Into Account Churn With Your Retention Heatmap

To give you an idea of why you might be losing customers to account churn, you can look at your Retention Heatmap which cohorts customers based on specific filters. By looking at where your customers dropoff, you can determine what areas need work.

If you notice a dropoff of a cohort horizontally, for example in the 01 Nov 2015 cohort at month 3, that means there’s likely a problem in your customer onboarding.

This can be caused by things like:

- A customer success manager still in training onboarding a big cohort

- Bringing in the wrong type of customer during a certain period

If you notice a dropoff along the vertical access, for example along month 13 for all cohorts up to 01 Jan 2016, this usually lines up with the end of a period.

This dropoff means that the year is up and these customers have not yet renewed their annual plans. Work with your customer success team as the end-of-period approaches to make sure they’re set up for renewal. Keeping an eye on your retention heatmap will alert you when problems arise so that you can fix them in a timely manner.

One downside to account churn is that it doesn’t take into account upgrades or upsells of accounts. This kind of expansion revenue is crucial for keeping larger businesses growing, but is not reflected in account churn numbers. To take that into account, you need to look at your revenue churn.

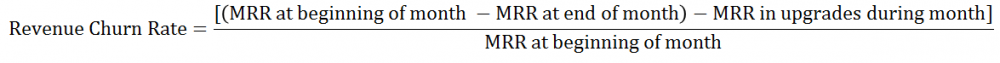

Retention Metric #2: Revenue Churn

The lowest account churn can go is 0%, which means you’re experiencing 100% account retention. While this is great, it really sets a limit on how much you can improve. With revenue churn, you can improve much more than 100%.

The magical thing about this revenue churn formula is that with the right amount of expansion revenue, you can achieve negative churn, which means you’re adding MRR at a faster pace than you’re losing it.

Your Churn Rate: Revenue Churn report will show you how your revenue churn has changed over time. In this example we can see that at some points the company dips into negative churn, but overall they still have a slightly positive average revenue churn at 0.1%.

Achieving the Best Kind of Revenue Churn: Negative Churn

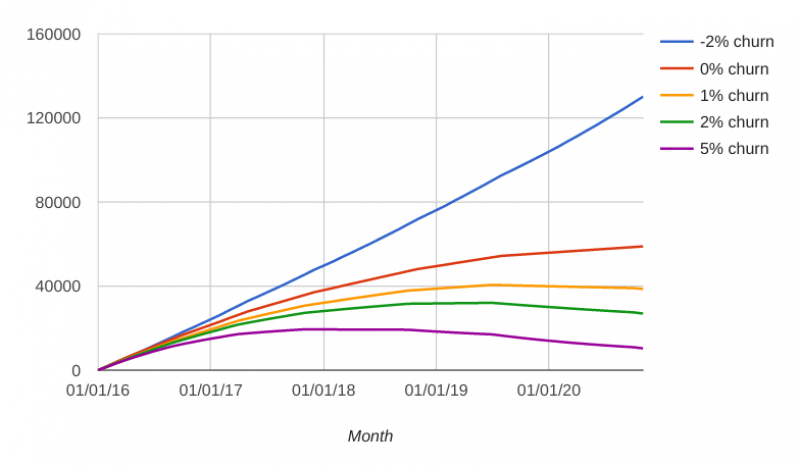

So why exactly is negative churn such a big deal? We know that a lot of top performing SaaS companies are growing because of their negative churn rates but why?

The answer has to do with how your churn affects you over time. With even a small percentage of positive churn, eventually growing revenue won’t be enough to counter the effects of cancellations and downgrades. Soon your revenue will start to decrease because your churn continues to do just that — churn away at your revenue.

But if we take a look at this figure from pricing service ProfitWell, we can see that negative churn does the exact opposite. Negative churn will outpace whatever revenue you’re losing and your business will continue to grow. Having this buffer of average negative churn means that your company can survive any periods where churn dips back into the positive numbers.

So how do you achieve negative churn? There are three main strategies according to VC Tom Tunguz:

- Usage expansion. This means increasing the account sizes of your current customers. Pricing by unit is a great way to have customers increase their accounts when they buy more seats.

- Feature expansion. Also known as up-selling. This means selling your customers on higher plans than the one they currently have.

- Product expansion. Which is also called cross-selling. This means selling customers on other products you provide so that there are more of what you have to offer.

A great way to identify potential expansion revenue opportunities is to look for high-grade companies during the initial selling process. These are companies that you can likely that you can upsell multiple products to, because they’re more likely to have an interest in using multiple aspects of what your product can offer. Upselling helps you bring in more revenue, without having to spend the time and money necessary to onboard a completely new customer.

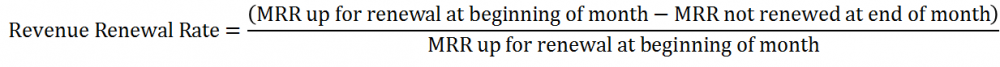

Retention Metric #3: Renewal Rate

Renewal rate helps you determine how much of your revenue you’re successfully renewing each period.

Something to take into account when calculating renewal rate is how long that you set the length of each contract will affect how many accounts are up for renewal in a given period. That means, if you make substantial improvements to customer onboarding or product features, it may take a while before those are reflected in renewal rates if your contracts are a year or longer.

Your Renewal Rate report can show how your renewal rate is changing over time. For each period you can see how many accounts renewed successfully, how many failed, and how many are still up for renewal. In this example 52.3% of accounts have renewed in the past year. That means the company has lost almost 50% of their customers in a year — not great! If your renewal rate starts falling, you will need to look into what’s causing so many accounts to cancel so that you don’t continue to lose more.

Understand How Renewal Rate Affects Customer Lifetime Value

The importance of renewal rate relates to each customer’s lifetime value (LTV). Each customer costs a certain amount of money to acquire and onboard, which is called the Customer Acquisition Cost. Over time, each customer should pay back this CAC in while building up their LTV.

This equation takes how much you’re earning from each customer on average and divides it by how many of your customers churn on average each month. It calculates the amount each current customer can be expected to pay during the remainder of their lifetime with the company.

Making sure that customers renew means that they will continue to add to their LTV and make up for the CAC needed to bring them in as a customer. If a customer churns out before their LTV can exceed the CAC, that means you’re losing money and something needs to change.

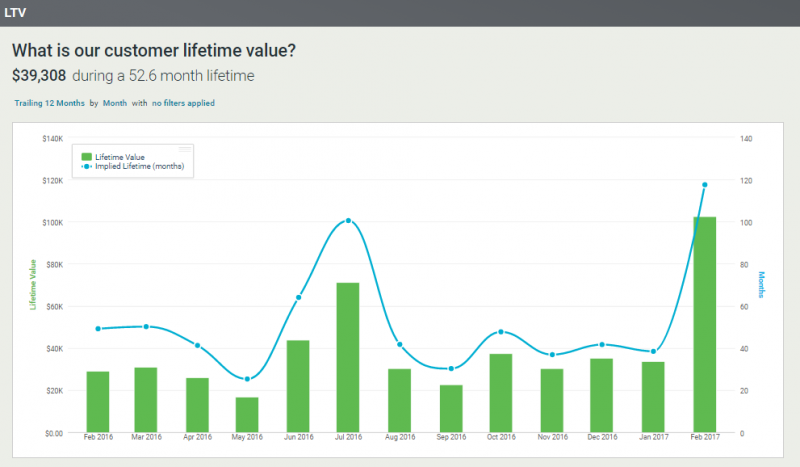

Your LTV report will show how your customer LTV is changing over time in relation to average lifetime. This report depends on the amount of bookings you have in a period and it automatically adjusts so you don’t have to do the calculation of what your churn rate looks like over time, while also automatically adjusting for your churn rates. In this example the company has a customer LTV of $ 39,308 during a 52.6 month lifetime. That means on average, each customer will give them $ 39,308 over 52.6 months at the company.

By comparing your LTV with what your average CAC is, you can see if you’re losing or earning money over time and make changes if necessary.

The Importance of SaaS Metrics

SaaS companies run a unique business model that is much more customer-focused than more traditional business models. This means they need a unique set of metrics to make sure that their business is on track and growing in a sustainable way.

Now that you understand how SaaS companies calculate revenue and retention, you can start seeing how your company compares to these benchmarks and set your company up for success.

Business & Finance Articles on Business 2 Community(101)

Report Post