Silicon Valley oracle Andreessen Horowitz on Thursday released its annual list of 100 fastest-growing consumer marketplaces (i.e. any platform that connects buyers with sellers), which ranked private companies by metrics like web traffic and credit card revenue.

In a repeat of last year, grocery delivery startup Instacart took first place—and by a wide margin, accounting for 64.2% of the gross merchandise value of the entire list. Video game developer Valve, which created the popular gaming platform Steam, came second, and online ticket booth Seat Geek was third, followed by car-share service Turo and sneaker reseller StockX. (Previous companies on the list that went public include Airbnb, DoorDash, and Coursera.)

Instacart, with its whopping portion of the startup wealth, is an interesting case study. Only two other grocers landed in the top 100—both in the bottom half, and with 0.1% or less of Instacart’s consumer activity. The grocery business tends to have a “winner-take-all” dynamic, a16z notes: For product suppliers, it’s hard to work with multiple vendors, given transportation and inventory logistics, meaning most only serve a few stores at once. Meanwhile, a few big grocers typically deliver the vast majority of the goods consumers demand. While that hasn’t stopped a proliferation of grocery couriers from cropping up—like Gopuff, Getir, and Gorillas, for example—it might also explain why so many have been culled (see: BuyK, Fridge No More).

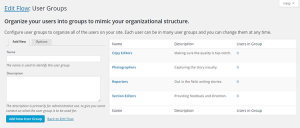

What other industries could become winner-take-all arenas? According to the firm, there were seven categories with only one company each in the top 100. They were:

It’s possible that one of these companies becomes the next solo billion-dollar unicorn in its category—particularly for emerging spaces like cannabis, which is slowly becoming legalized across the country; and celebrity engagement, with Cameo kickstarting a new trend during the pandemic.

However, it’s also worth noting that others may be joining a bustling market with established public companies—and as a16z notes, many of those markets lack the supplier bottlenecks that limit the success stories in groceries.

What could be tougher is the vibe in startup-land, which has seen many venture-backed hopefuls aspire to own their markets, but nevertheless struggle to make profits (such as Warby Parker for direct-to-consumer eyewear, or Rent the Runway for clothing subscriptions). However, it’s not impossible: Amazon was famously unprofitable for decades, before it grew to dominate e-commerce.

(40)

Report Post