U.S. Credit Rating Downgrade: How It Affects Advertising

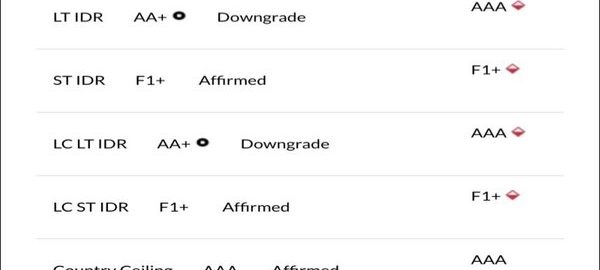

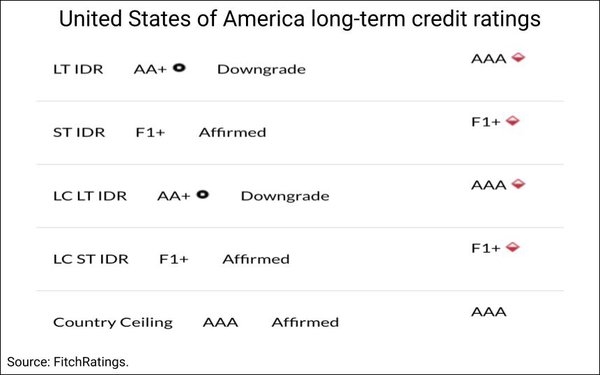

The Fitch Ratings agency last week announced that it would downgrade its long-term credit rating of the United States from AAA to AA+ with a stable outlook. It forced the stock market rally to take a breather, and drove up interest rates in the housing market.

This is not the first time Fitch has downgraded the U.S. rating. It happened in 2011 under the Obama administration. But some who represent advertising agencies said it is not quite the same circumstances.

Although it has not been determined how the downgrade will affect the advertising industry, as companies and brands make decisions about which media to buy and where to spend budgets, some look back to the last downgrade in 2011 to share opinions.

“There’s no simple answer,” said Kevin Lee, founder of several companies including Didit, a digital marketing and technology firm. “The main risk is that it continues to drive up interest rates, which indirectly slows marketing investments, since some businesses borrow money to grow.”

That could have a “chilling effect on ad spend,” he said, pointing to the amount that companies spend on branding and awareness.

Tim Daly, founder of the marketing agency Vincodo, noted that there was no impact in 2011, but digital marketing was in the early stages of adoption. He does not anticipate a major concern unless consumers’ confidence slips as a result of the downgrade.

Paul Darling, NP Digital CFO, called the downgrade a “macro-economic decision” that many people may not have heard about or understand. “I don’t think this decision on its own will have any meaningful impact on advertising and marketing spend,” he said. “Moody’s also said that U.S. treasury bonds are still the safest asset on the planet. If anything, any impact from this will be further down the road, rather than immediate.”

Darling said that other economic indicators and factors, both positive and negative, may have a greater influence on consumers and companies in terms of spending. Current consumer behavior is contradictory to what might be expected.

Positive economic indicators point to rising stock markets, low unemployment, increased wages and some signs of lower inflation.

Darling says these indicators present a more bullish outlook for consumers and for NP Digital’s clients and brands that continue to spend on marketing and advertising.

The one caveat is an increase in interest rates. That is one change that hits closest to home for most consumers and adds to the high inflation experienced during the past 12 months, although it has come down a bit. This has all led to decreased consumer sentiment, Darling said.

“I have no doubt that this has caused advertisers to be more cautious on how and where they spend, and perhaps more so, especially for the small and medium-size businesses whose priority is to preserve cash flow,” he said. “So, I don’t think the latest downgrade will make a huge difference to how advertisers will behave, but we will continue to see some element of caution from our clients similar to what we have been experiencing in the past six to nine months.”

(13)

Report Post