Account-based marketing is evolving rapidly. Here are seven of the top developments in the space.

B2B marketers have employed account-based marketing (ABM) for well over a decade, of course, but the space has evolved rapidly over the past two to three years.

Factors driving changes in ABM include shifts in buyer preferences and pre-purchase behavior, as well as the development of more sophisticated technology and data products that enable marketers to analyze behavior, identify in-market audiences, and craft experiences for a buying group or its individual members.

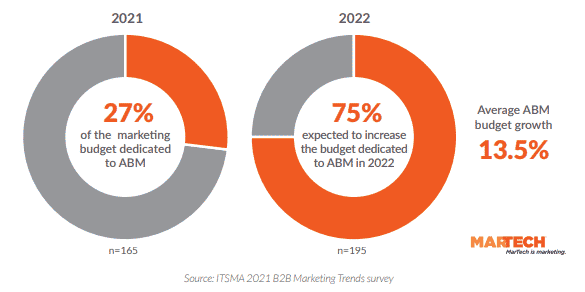

Additionally, the COVID pandemic accelerated fundamental shifts in the B2B buying cycle by forcing events and in-person meetings to go virtual. A survey by the IT Sales and Marketing Association (ITSMA) found 27% of the marketing budget dedicated to ABM in 2021, with 75% of those surveyed saying they planned to increase spending on ABM in 2022.

Even a return to the “new normal,” however unlikely that may current seem, isn’t expected to slow the growth of ABM, because the trends driving the changes in buyer behavior have long been brewing.

How B2B buying has changed

For some time, B2B buyers have conducted substantial research online before talking to a salesperson, and the vast amount of information available to buyers has given them an upper hand. The lockdowns, canceled events and work-from-home trends that characterized the pandemic period exaggerated this phenomenon, and, even as in-person opportunities return, the buying cycle has been forever changed.

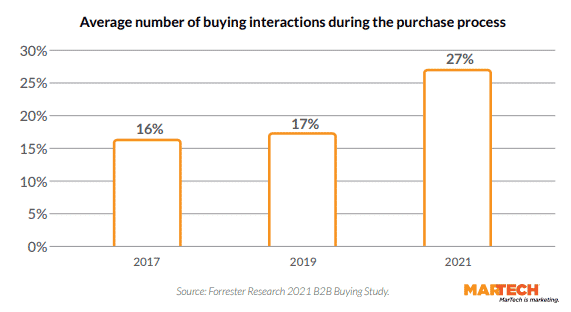

Last year, Forrester Research found the average number of buying interactions occurring during the purchase process soared by 10 to 27 in 2021. This trend shows that buyers are determined to do their due diligence before making purchase decisions, raising the importance of the personalized, targeted experiences enabled by ABM technologies.

Digital engagement, Salesforce notes in its most recent “State of the Connected Customer”

report, “hit a tipping point” in 2021, when an estimated 60% of interactions took place online,

compared to 42% the year before.

This shift from a reactive to proactive marketing approach is working well for many B2B

companies.

The vendors respond

A great number of ABM vendors provide everything from all-in-one platforms to enable ABM strategies, to adjacent services like data enrichment, identity resolution, analytics, and interaction management/orchestration to B2B marketers ramping up their programs. The more comprehensive platforms come from B2B mainstays such as Dun & Bradstreet, Salesforce and Marketo, which share the space with a growing group of independent ABM platforms including 6Sense, Integrate, Demandbase, Bombora, Jabmo, RollWorks (a division of NextRoll), N. Rich, MRP, Madison Logic, Terminus and more.

Here are seven of the top developments we are monitoring:

1. Platforms, not point solutions

Where the ABM landscape dominated by point solutions offering specific elements of the mix, but now, through partnerships, consolidation and technological development, many vendors offer more comprehensive solutions.

2. Consolidation of ABM and demand gen

Another notable development among ABM vendors is the move to consolidate ABM with demand generation. Many vendors are buying into the vision of eliminating the distinction between these two elements of B2B selling and are developing the tools to enable marketers to carry it out. For example, Demandbase calls this convergence its “Smarter Go-To Market” offering, while Kwanzoo

expects a B2B Go-To Market suite — anchored by its B2B GTM platform — to become standard.

Madison Logic calls its solution “Journey Acceleration,” and Salesforce expects businesses

to align all of their customer-facing activity (marketing, sales and customer service) on the

Salesforce Customer 360 Platform. Meanwhile, Terminus and Dun & Bradstreet are unifying

around a CDP.

3. More M&A

Most vendors we surveyed expect merger and acquisition activity to pick up in the space as the larger players build more comprehensive platforms. Inflation worries, interest rate hikes and general economic uncertainty are also factors here, since they all contribute to a less-attractive IPO market, leading venture-funded companies to seek M&A opportunities.

4. Deeper investments in AI

In addition to consolidating their tool sets, vendors are also investing heavily in artificial intelligence (AI) to deepen the data insights available through their tools, as well as the targeting and relevance of marketing execution. More vendors have introduced recommendation engines that analyze multiple data sources to provide “next-best-actions” based on account intent and behavior signals.

5. Help for the sales team

To enhance the alignment between B2B sales and marketing teams, vendors are also adding sales enablement tools that automatically activate sales triggers based on CRM account reporting, and provide lead-to-account mapping, for example. The goal is to streamline the “hand-off” of leads from marketing to sales.

6. Efficiency across channels

Interaction management, or orchestration, is a key feature for many ABM vendors profiled in this report, which are expanding the number of channels that can be managed through their tools. Vendors are building out APIs and increasing the availability of native (outof-the-box) integrations with CRMs, marketing automation systems, digital ad networks and other ABM data providers.

7. The growing importance of compliance

While data unquestionably drives value, it can also create difficulties with complying

with privacy regulations especially for those businesses looking to take their ABM programs

global. This is why many vendors touted their capabilities for data management and compliance

as they gear up to support global marketing initiatives.

The post What is account-based marketing today and how has the space evolved? appeared first on MarTech.

(22)

Report Post