Sources of funding go far beyond traditional bank loans. From family and friends to leasing and factoring, crowdfunding campaigns and government grants, businesses have plenty of options to consider.

Although there are a variety of financing options out there, about 95 percent of all start-ups are funded, in part, by personal savings and funds from family and friends. So, that is the place to start.

Beginning with personal funds, consider taking a home equity loan, maxing out your credit cards, or using your savings and retirement accounts.

Family and friends are your next source. This route tends to be informal as they are investing as much in you as in your business idea. However, it is still an investment, and you don’t want to lose friends or relatives if your business should go south. It’s best to treat the arrangement like any other business deal. Present your “investors” with your business plan (you can simplify it if you like) so they can make an informed decision.

Once they are on board, draw up a formal business agreement detailing the terms and if the money is expected to be paid back or only if the company does well.

If you still need capital after using personal funds and going to family and friends, your choices other than a traditional bank loan or an angel investment come down two categories: sources that either require you to pay the money back, with interest, or carry no payback obligation.

Here’s a brief summary of these options:

Sources that need to be paid back

- Microloans: The SBA’s Microloan Program provides small businesses with short-term loans for working capital or the purchase of inventory, supplies, furniture, fixtures, machinery and/or equipment. The SBA makes funds available to specially designated intermediary lenders, which are nonprofit organizations with experience in lending and technical assistance. These intermediaries then make loans to eligible borrowers in amounts up to a maximum of $ 50,000. The average loan size is about $ 13,000. See sba.gov for more information.

- Peer-to-peer lending (P2P): Individual lenders are matched with individual borrowers through an online platform. P2P lending comes in two sizes. For loans less than $ 5,000 see kiva.org and www.kivazip.org for examples. For P2P loans up to $ 35,000 see www.lendingclub.com and www.prosper.com for examples. These 4 links are examples of the programs and not endorsements of these particular products.

- Leasing: If you need a building, equipment or a vehicle for your business, consider leasing rather than purchase. Then, when your business generates sufficient cash, convert the lease to a purchase. While total costs under a lease might be more expensive, up front the monthly expenditures are less than the purchase price, which provides some cash flow flexibility. A lease negotiation has many of the same attributes as a bank loan, so it should not be viewed as a shortcut or reason not to prepare a business plan.

- Factors: Factors provide short-term financing in exchange for accounts receivable (A/R). These companies purchase your A/R up front, paying 80 to 90 percent of the value, and then handle the collection. They pay the remainder less their commission when all the funds are collected. The better quality your A/R is, the better terms you can negotiate. To find a factor, contact the International Factoring Association at factoring.org.

- Monthly Recurring Revenue (MRR) financing: If you have a Software as a Service (SaaS) business, you have a predictable amount of monthly recurring revenue, or MRR, and some companies will make loans against this. Often the collection is via a lockbox in the name of the lender, like in the case of factors.

- Contracts or purchase orders: Some lenders will use these as the collateral if they are from reputable companies. While this sounds good on paper, it is not a common financing vehicle. Even when the customer is the U.S. government, the lender will probe your ability to service the contract, the customer’s ability to cancel the contract, and in some cases, the customer’s invoice slow pay reputation.

Sources with no Payback Obligation

- Crowdfunding: Crowdfunding, in which you solicit financial contributions from a large number of people, typically through an online site, is gaining popularity. There are well over 100 crowd funding sites, many with a particular focus like restaurants, real estate, nonprofits, etc. Kickstarter and Indiegogo are two of the most widely known.

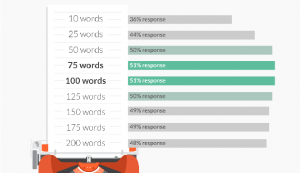

In general, crowdfunding companies provide the site and the mechanics for contributors to make a donation. Each site has different operating details, so make sure you know what they are. Your goal is to develop and tell a story — often with a video — that is compelling enough to have individuals make a contribution.

If you are considering a crowdfunding campaign, start building your followers/fans now on social media. According to Kickstarter, the most popular contribution is $ 25, so if you have a $ 25,000 campaign, you will need, on average, 1,000 contributors, and if 1 in 10 followers/fans contribute, you will need a starting list of 10,000 names.

Crowdfunding is not well suited to companies that do not have a competitive advantage secured by trade secrets or strong patents, as once posted, your idea is ripe for being copied or stolen.

In most instances, funds secured from crowdfunding are considered contributions, and do not need to be repaid. To provide an incentive for contributions, you may provide a prize or reward.

- Equity Crowdfunding. “Accredited” investors (high net worth individuals) have always been able to invest in early stage companies and several online platforms such as angellist.com and www.gust.com facilitate such investments. As part of the 2013 U.S. Jobs Act, the Securities and Exchange Commission (SEC) is to issue rules permitting small investors to make equity investments in companies via crowdfunding. In late March 2015 these rules were issued as Regulation A+, to be effective in 60 days. So as of this writing there is no experience to report. As of this writing, no guidelines have been released.

- Small Business Innovation Research (SBIR) Program: SBIR is a highly competitive awards-based program that encourages domestic small businesses to engage in federal research and development, which has the potential for commercialization. SBIR enables small businesses to explore their technological potential and provides the incentive to profit from its commercialization. See sbir.gov for more information and to determine if you qualify.

Key Lessons

- There are many funding sources besides the traditional bank loan.

- Each is unique, so understanding the details is important.

- Crowdfunding is becoming very popular, but it requires a fair amount of effort to execute successfully.

(295)