Branded is a weekly column devoted to the intersection of marketing, business, design, and culture.

As popular as it is, TikTok has critics—very serious critics, with very serious concerns. This isn’t just the usual social-media griping (misinformation, dubious trends, etc.). The addictive-video app has already been banned from government devices in 19 states, and its use restricted on multiple state university campuses. Plus, the spending bill President Joe Biden signed at the end of last year prohibits millions of federal employees from using TikTok on agency devices.

The underlying concern is that the Chinese-owned app may be used as a data-gathering espionage machine, its parent company ByteDance functioning as a government “puppet,” as Senator Marco Rubio has put it. “It is time to ban Beijing-controlled TikTok for good,” he said in a statement last month.

The app has been banned outright in India, and ByteDance has admitted shady data-tracking of journalists and others by what it says were rogue employees who have been fired. “Seemingly every Big Tech company is facing unprecedented levels of scrutiny these days,” Vox noted recently, “but TikTok faces opposition that its peers don’t.”

On the other hand, at least one important constituency doesn’t seem to have concerns about TikTok at all—advertisers.

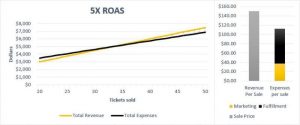

Contrary to the myriad TikTok critics, marketers “can’t stop pouring money” into TikTok ad buys,” Digiday reports, “despite some big question marks over whether those ad dollars could be funding growing tensions between the U.S. and China.” Regardless of the broader slowdown in online ad spending, multiple marketers and agencies report increased buy-ins to campaigns on TikTok. A recent report from market research firm Cowen surveyed 50 U.S. ad buyers and found a similar TikTok embrace amid more cautious spending plans, with 60% naming TikTok as their preferred short-form video venue. Standard Media Index reports that, as of November, ByteDance’s share of big agency spending on social media had vaulted 9 points, to 11%. For individual agencies, it appears the jump is even more pronounced. One told Digiday the platform would claim about 25% of its clients’ social media spend, a 50% increase over last year. Another specifically pointed out that these increases include ad spending that might have otherwise been deployed on Twitter, but “that TikTok has been able to pull into its ads business.”

Twitter is, in fact, a useful counterpoint. It’s been widely noted that many advertisers have pulled back from the platform since Elon Musk bought it and simultaneously promised a more permissive “free speech” environment while slashing content moderation as part of an instant mass reduction in head count. The result has been months of apparent chaos and controversy. Advertisers, famously averse to contention and discord, have remained wary.

That’s why TikTok’s resilience as an ad-dollar magnet—indeed, its increasingly unfettered trajectory toward dominance—is so remarkable. If being an alleged tool of foreign government surveillance isn’t controversial, what is?

The most likely answer is that the real issue isn’t what advertisers may think. It’s what they think consumers may think. And despite all the political posturing and/or concern about TikTok and its parent company, there’s very little evidence of wariness among its users—particularly the Gen Z members that marketers covet.

For example, the New York Times recently visited Auburn to see what its students thought of the university’s TikTok block on its campus Wi-Fi network. Students didn’t seem to see the decision as a response to a plausible national security risk. They saw it as an irritation. “All social media apps collect your data,” one pointed out. “I really don’t think my generation, in particular, is going to really change the way we use the app,” she added. “It’s so big at this point.”

Indeed, if the idea of booting TikTok seemed like a challenge when it first surfaced in the U.S. during the Trump years, it’s nearly impossible to imagine now. TikTok is so entrenched in our everyday culture, in our digital life, in general, with 138 million active users in the U.S. and more than 1 billion worldwide. It was the most-downloaded app last year, and it’s come to be relied on by a wide range of entrepreneurs, creators, and, of course, brands. Meanwhile, ByteDance has ramped up its lobbying efforts, spending more than $1 billion in an effort to rebuild some of its back-end technology on servers in the U.S., to theoretically wall off the data of U.S. users from itself or China, in general.

All that said, there are a few asterisks to TikTok’s apparent success with advertisers: Its revenue is still far below the likes of Meta, its current cost per thousand impressions is relatively low, and it is still proving its effectiveness as an ad medium. But controversy? Seemingly a nonissue for advertisers.

At this point, in fact, blocking TikTok outright would be a fairly courageous political act: Potential espionage links notwithstanding, the app is surely more popular than most any elected official. The New Republic recently argued that there may be legitimate concerns around TikTok and privacy, but that most of the ban rhetoric has been an example of “stunt legislation”—designed merely to hog the limelight and score points. After all, attracting attention and sustaining it is the name of the game. Just ask all those advertisers flocking to TikTok.

(16)

Report Post